By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

Inflation’s Cool Down has Cooled

Earlier this year, markets were optimistic that falling inflation would enable the Fed to cut rates more aggressively than the Fed was projecting. Unfortunately, as noted by Liz Ann Sonders and Kevin Gordon, progress against inflation has slowed, and markets are now anticipating (along with the Fed) three 25bp rate cuts later this year instead of twice that number.

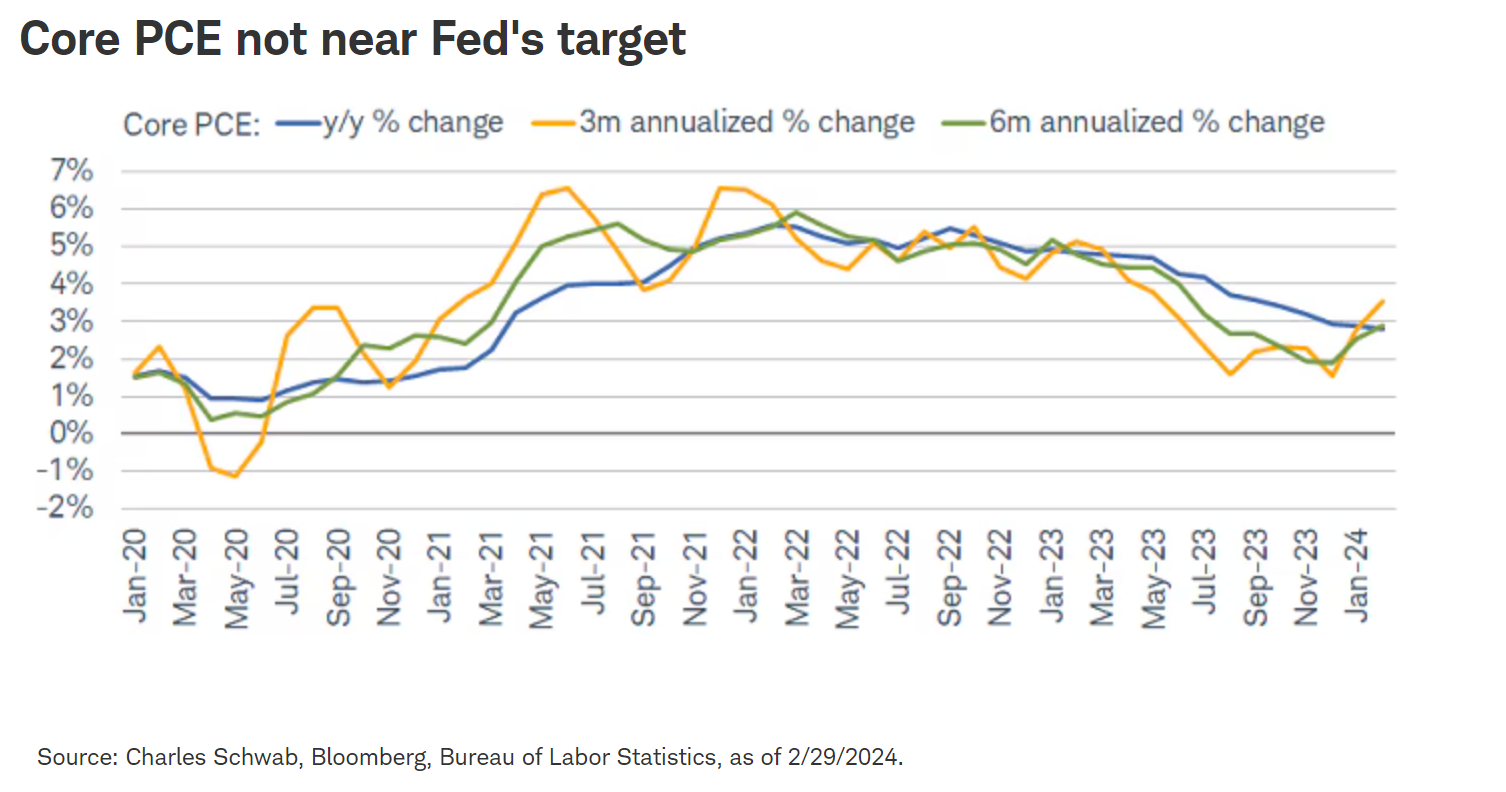

Core PCE (Personal Consumption Expenditures, excluding food and energy) inflation, a number closely scrutinized by the Fed, has increased over the past 3 months:

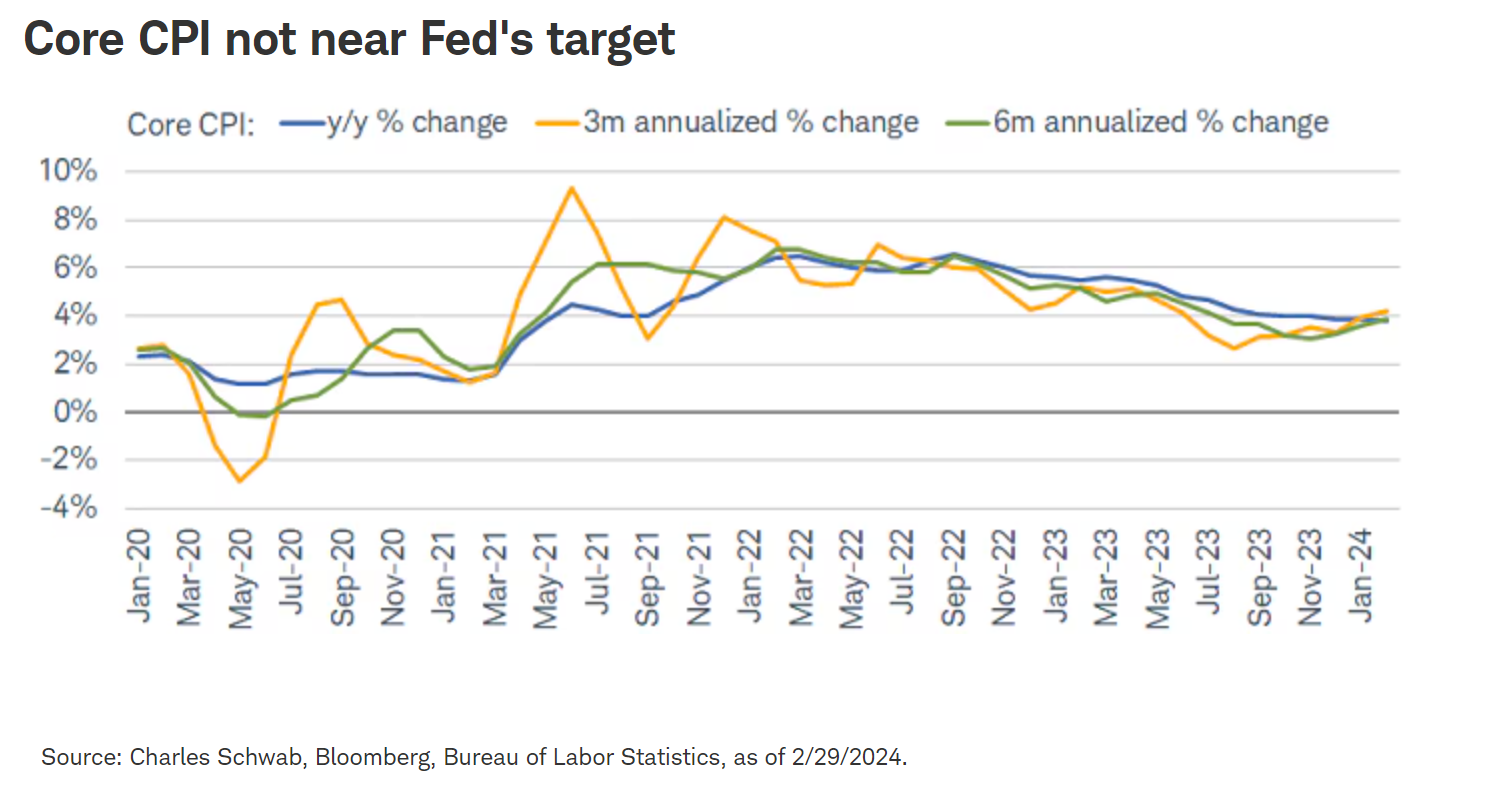

Inflation has clearly fallen significantly from its peak, but appears to be trending at a 3% clip rather than the Fed’s 2% target. Core CPI (Consumer Price Index) inflation tells a similar story:

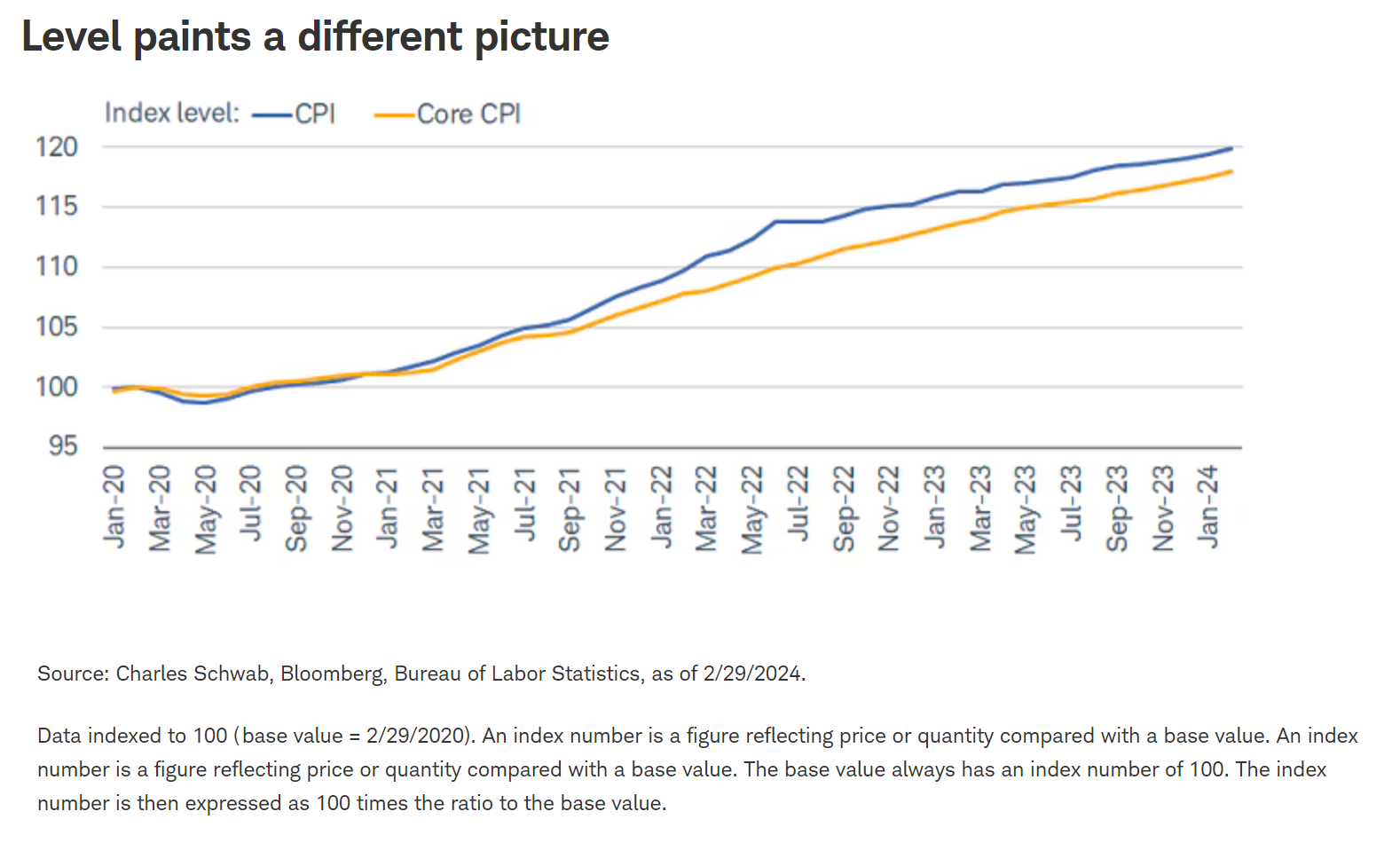

Sonders and Gordon also provide information on price levels; if you’re wondering why many people are unhappy with President Biden’s stewardship of the economy, this chart provides a plausible explanation:

Prices are roughly 20% higher since the onset of the pandemic 4 years ago. Given the surge in inflation in 2021 and 2022 it is understandable that the Fed would take a cautious approach to rate cuts, lest high inflation become embedded in consumer and producer expectations.

And so, as Sonders and Gordon observe, we are in an unusual situation—traditionally, the Fed takes the escalator up and the elevator down—in order words, the Fed has historically raised rates slowly then later cut rates quickly. For this inflation surge, however, the Fed has raised rates at an unprecedented clip, and has now paused to assess the impact of these rate hikes on the overall economy. The Fed has been able to pause because of the economy’s continued resilience—with inflation elevated not alarmingly so, there’s little pressure for the Fed to risk provoking a recession by raising rates again, or risk an inflation resurgence by easing too much, too soon. Sonders and Gordon quote Fed Chair Jerome Powell as remarking that “we will be careful about this decision…because we can.”

And so we wait. If inflation moves closer to the 2% target, the Fed will likely enter a slow-but-steady rate cutting regime. If the labor market suddenly falters, then the Fed has the flexibility to slash rates more aggressively. For now, though, Sonders and Gordon compellingly argue that so long as the economy remains healthy, the Fed is likely to use the escalator, and not the elevator, in bringing rates down.

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. This material has been prepared for informational purposes only, and is not intended to be or interpreted as a recommendation. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice.

‹ Back