By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

The Long View on International Stocks

Valuations for developed international stocks have been attractive for several years, and we consider them to be an important component of diversified portfolios, despite the fact that they have underperformed US stocks for many years. Ben Carlson provides some important long-term context for international, domestic, and tech stocks.

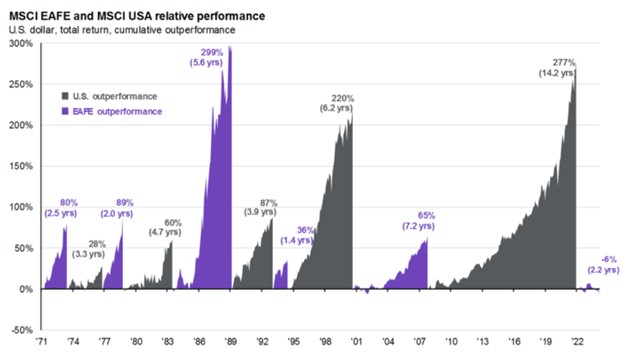

Carlson notes that the current cycle of outperformance by US stocks is unusually long:

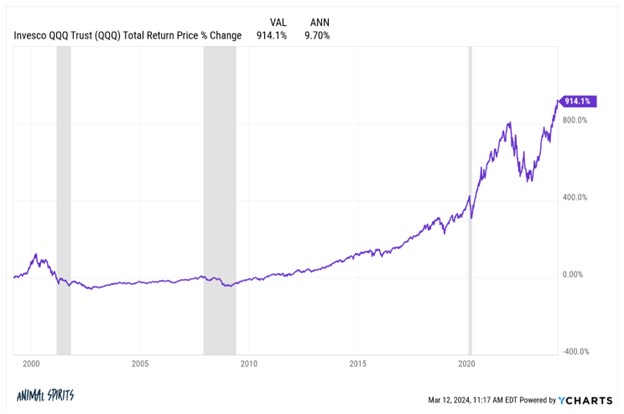

Carlson points out that 15 years ago the hot investment trends were emerging markets, China, or commodities—all market areas with a strong short-term track record back then. Interest in the tech stocks that would fuel US outperformance over the ensuing years was subdued. The NASDAQ 100, which cratered when the tech bubble burst at the turn of the century, took over a decade to recover:

Carlson points out that if you combine the negative cycle at the start of the century with the positive cycle over the past decade, you end up with overall performance approximately equal to the average of the stock market over that period—in the end, the bad balanced out the good.

Carlson comments that periods of outperformance for market areas or strategies can last over a decade. And after US dominance over the past decade, it may feel like this pattern will continue indefinitely—and perhaps it might. But US post-WWII dominance eventually faded, as did Japan’s dominant run in the 1980s. And while we can’t predict the future, we can prepare for it, and just in case US tech dominance wanes in the coming years, international investments may be ready to pick up the slack.

###

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. This material has been prepared for informational purposes only, and is not intended to be or interpreted as a recommendation. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice.

‹ Back