By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

Items of Note

Here are a few stories that caught our attention over the past week:

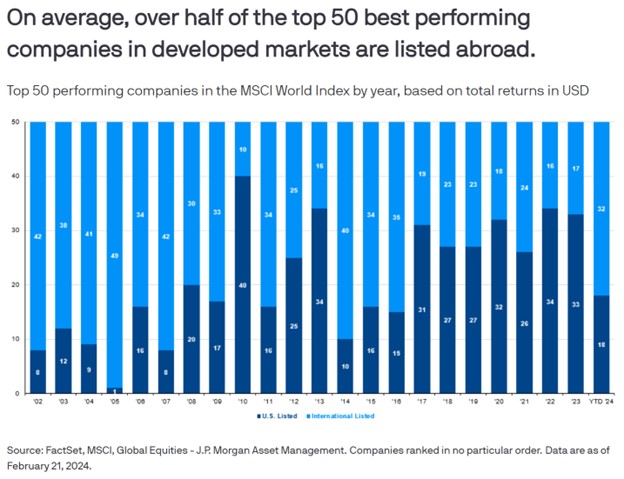

First, a reminder that while tech stocks such as Nvidia have propelled the current S&P 500 surge, high performance stocks are broadly distributed around the globe:

The obvious implication is that a diversified portfolio can capture broadly distributed gains; given that current valuations of US large cap stocks are elevated, the case for international markets becomes even stronger.

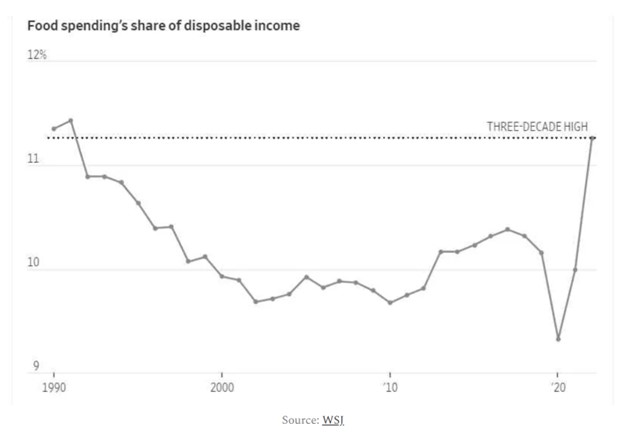

Next, Noah Smith cites an example of graphic abuse from the Wall Street Journal:

Notice the y-axis starts at 9 and ends at 12, so that the relative increase in food spending appears more dire. Smith also puts this increase into context—although people are spending a larger share of their income on food over the past 3 years, this number has fallen dramatically over recent decades:

Smith does a further breakdown and finds that restaurant spending, and not grocery spending, accounts for the food expenditures increase. While inflation has had an effect on food affordability, its impact does not appear to be dire, even if the story remains more than a nothingburger.

And speaking of burgers…

Wendy’s has backed off a plan to test out “dynamic pricing,” in which prices could increase during peak hours. After mockery on social media and grandstanding from politicians, Wendy’s clarified that it was adding digital menuboards to some stores in order to enable fast price changes so that the stores could offer discounts to customers during slow periods.

Catherine Rampell notes that outrage about restaurants varying their prices by the time of day is misplaced, given that such practices are common. She observes that consumers seem more accepting of discounted prices during slow periods rather than increased prices during peak periods, even though these two concepts are mathematically equivalent. Framing variable prices as happy hours or early bird specials seems like the way to go.

###

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. This material has been prepared for informational purposes only, and is not intended to be or interpreted as a recommendation. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice.

‹ Back