By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

Quarterly Market Commentary 2023

Second Quarter 2023 Key Takeaways

The second quarter of 2023 might be all about the dogs that didn’t bark. Labor markets remained strong amidst continued Fed rate hikes. Housing markets cooled but didn’t crater. The debt ceiling cliff was settled until 2025. Regional bank failures didn’t heavily metastasize through broader financial markets. Inflation has taken downward steps without the accompaniment of a recession. Continued GDP growth raises the likelihood of a soft landing for the economy as the Fed continues its inflation fight. And this absence of bad news was good news for markets, which showed another quarter of steady gains as they continue to claw back from the 2022 downturn.

The S&P 500 climbed another 8.7% in Q2 2023 and was up 16.9% over the first half of the year. Developed international and emerging markets posted smaller gains for the quarter of 3.2% and 1.0%, respectively; these segments of the market are up 12.1% and 5.0%, respectively, through June 30th. The Russell 2000 was up 5.2% in Q2 2023 and 8.1% for the year as of quarter’s end. Bonds had a mixed performance in the second quarter, with the US agg posting a small decline of 0.8% in Q2 but high yield bonds gaining 1.7% over that span. Treasury rates rose over the quarter, particularly with respect to shorter‐term bonds, as the Fed indicated the likelihood of sending rates higher, and for longer.

GDP growth has continued to prove surprisingly resilient. Q1 2023 GDP growth estimates have been revised upwards to 2.0%, and Q2 GDP growth as of now is expected to stay in positive territory. Recession forecasts are still numerous, but the chances of a soft landing for the economy have improved. The labor market has shown some signs of loosening, but it’s still been surprisingly strong—with the June unemployment rate at just 3.6%‐‐ even though the Fed has raised rates by 5% over the past 18 months. Headline inflation has fallen significantly, largely due to a fall in energy prices, but core inflation has made more limited progress.

As noted, the Fed has signaled its intention to further raise the federal funds rate, which it did in May, and to maintain elevated rates for a period of time longer than it and markets had previously anticipated. The economy’s continued strength, though perhaps a source of core inflation’s persistence, may also be providing the Fed a greater runway to keep rates higher for longer without provoking a severe recession. Given the runup in equities, economic optimism is likely priced in to a significant extent, and while we would anticipate the economy landing somewhere between slow growth and a mild recession over the medium term, a negative surprise could pull the plug on what’s been a steady recovery through the first half of the year.

Second Quarter 2023 Investment Letter

The second quarter of 2023 marked a continuation of the uptick begun in the fourth quarter of 2022. The Fed is still raising rates, but only at a 25bp clip most recently. Headline inflation has fallen sharply, and while core inflation remains mired well above target, it is still down from its peak. The regional bank panic sparked by Silicon Valley Bank’s collapse appears to be contained. Tech stocks, which bore the brunt of the 2022 downturn, have come back strong in the first half of 2023. Given the 17% gain in the S&P 500 year to date, we would not be surprised to see that market cool over the coming months, but continued macroeconomic strength and progress in the inflation fight could help provide ballast should the exuberance for technology and artificial intelligence wane.

Second Quarter 2023 Market Update

The second quarter of 2023 added to the recovery begun in the fourth quarter of 2022. The S&P 500 gained 8.7%, developed international 3.2%, emerging markets 1.0%, and the Russell 2000 5.2%. In terms of style, growth stocks, which bore the brunt of the bear market last year, have reaped the lion’s share of this year’s gains. In particular, large growth posted double digit gains in Q2, while other segments in growth and value also fared well, with quarterly gains generally in the mid single digits. For the first half of 2022, large growth, midcap growth, and small growth rose 29.0%, 15.9%, and 13.6%, respectively, and after a flat Q1, large value, mid value, and small value ended mid‐year up 5.1%, 5.2%, and 2.5%, respectively. Technology, communication services, and consumer discretionary were the best performing sectors this quarter, posting gains of between 13% and 17%. Year to date, these sectors have also spearheaded the S&P 500’s gains, as through June 30th technology climbed 42.8%, communication services rose 36.2%, and consumer discretionary gained 33.1%. Energy and utilities have fared the worst so far this year, with each dropping about 5%.

After a horrific 2022, and a degree of recovery in Q1, bond market progress stalled in Q2, as the persistence of inflation signaled a few more rate hikes stacked upon what’s already come before. The US agg dropped 0.8% and developed international bonds dipped 1.8%. High yield gained 1.7% but municipal bonds lost 0.1%. Still, through June 30th US bonds are up 2.1%, developed international bonds 1.6%, municipal bonds 2.7%, and high yield 5.4%. If inflation can be cooled, higher yields mean bonds can become a significantly better source of steady income. The 2‐year Treasury rate rose from 4.06% to 4.87% during Q2, reflecting expectations that the Fed will keep rates elevated in the medium term. The 10‐year rate and 30‐year rate also increased modestly, from 3.48% to 3.81%, and 3.67% to 3.85%, respectively. Volatility for the quarter was low, as the VIX was generally in the teens during the second quarter.

Update on the Macro Outlook

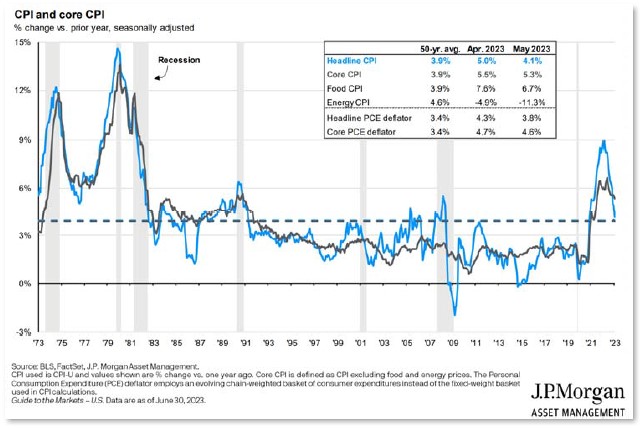

Inflation is still the headline‐grabbing blight on the macroeconomic landscape. The good news is that headline inflation has fallen significantly, thanks in large part to the plunge in energy prices. The bad news is that core inflation has been falling much more slowly and remains far above the Fed’s 2% target. The Fed has raised rates by 5%, and while it’s likely nearing the end of its tightening cycle, it is still expected to add another 25bp rate increase later in July. What’s the current status of inflation?

Headline inflation in January was 6.3%, so the decline to 4.1% in May represents a large step towards the 2% target.

However, core inflation, which excludes more volatile food and energy prices, was 5.5% in January, and by May had only fallen to 5.3%. Understandably, the Fed doesn’t want to see inflation stall out at around 5%, which could raise inflation expectations and embed inflation deeper into the economy. So once again the Fed has emphasized its willingness to keep rates higher for longer, and after a 25bp hike in May and a pause in June, it is expected to raise rates another 25bp in July.

We should note that the most recent inflation report was more promising, with core CPI rising only 0.2%, and the producer price index increasing just 0.1% in June. Moreover, shelter inflation, whose weight is about a third of the consumer price index, is expected to fall significantly in the coming months, while “sticky” inflation, which is akin to supercore inflation and excludes food, energy, and shelter costs, has made significantly more progress than core inflation:

Still, we want to be careful not to cherry pick numbers to push a particular viewpoint. While the likelihood of a soft landing has gone up, inflation remains well above target, and it’s best to wait and see whether this month’s news is just noise in the data or a signal of where inflation is heading.

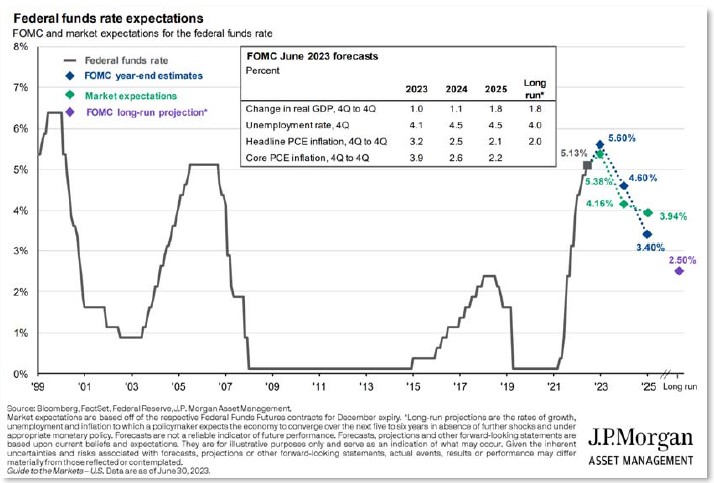

But the Fed has made clear where it’s heading with respect to rates—another small rate hike expected in July, with more as a possibility, though the greater impact of Fed policy will likely come from keeping rates high rather than setting a slightly higher peak.

We have noticed for some time that markets showed more optimism about the Fed cutting rates in 2023 than the Fed itself projected. However, limited progress in the spring against inflation has led to Fed and market projections that are in much closer alignment. (See JP Morgan chart, page 3.)

At this point, markets and the Fed mostly agree on the path of the federal funds rate, with markets projecting lower rates in 2024, and the Fed foreseeing lower rates in 2025—but the views differ only by about 50bp. The Fed’s projections for core inflation have grown more pessimistic in the short run—in March the Fed believed core inflation would be down to 3.6% by the end of 2023, but current projections are for a 3.9% inflation rate. Longer term views are still optimistic, with inflation easing to 2.5% by the close of 2024 with only a modest rise in unemployment to 4.5%. GDP growth is also projected to be positive throughout this period, which suggests a slowdown, and not a recession. Market inflation expectations, as illustrated by the 5‐year breakeven inflation rate, have consistently supported the belief that inflation will normalize, and that assessment continues to hold:

The 5‐year breakeven inflation rate is 2.2%, which is only marginally above the Fed’s target.

Though the fight against inflation has been more protracted than expected, the Fed and markets still expect that fight to be won. Given that the Fed has been seeking to cool inflation by cooling the economy, it is not surprising that GDP growth is expected to be slow in the near term. It could turn negative, pitching us into a recession, but either way, labor markets are likely to loosen to some extent in the near term. Though we are agnostic as to whether we’ll end up in a slowdown or in a recession, we believe that the progress against inflation, though sluggish, has somewhat lowered the tail risks to the economy from continued tight monetary policy, especially in light of the continued strength of the labor market.

Congress and the Biden Administration managed to reach a debt ceiling agreement that extends the debt ceiling until 2025. The war in Ukraine has been largely static, with the Ukrainian summer counteroffensive posting minimal territorial gains. While US‐China relations are likely to be challenging for many years, there don’t appear to be any imminent crises, though there’s always geopolitical tail risk on the horizon.

Portfolio Positioning and Closing Thoughts

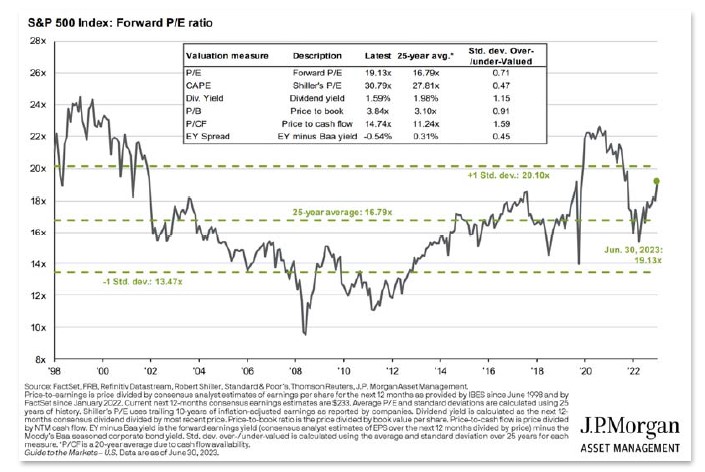

The good news about the S&P gaining 17% in the first half of 2023 is that the S&P gained 17%. The cautionary note is that US equity valuations have continued to shift into overvalued territory, though not egregiously so.

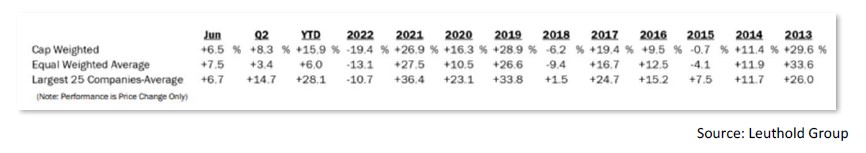

An additional complication is that gains within the S&P 500 this year have been unusually concentrated:

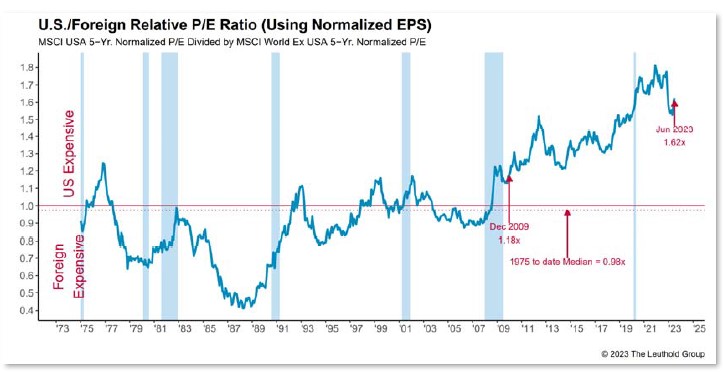

The equal weighted average return of the S&P 500 this year is 6.0%. The reason why the S&P 500 has performed so much better than that is that the largest companies, which have the most weight in the S&P 500, have flourished this year, with the top 25 companies averaging a 28.1% gain year to date. While large companies have generally beaten the overall index over the past decade, the 22.1% outperformance this year is highly unusual. Should the S&P 500 continue to drift higher, as it well could if earnings reports are strong and inflation eases more rapidly, the ongoing rally may distribute gains more broadly than the current tech‐ and AIheavy surge we’ve witnessed so far this year. We may also see tailwinds shifting more towards value and small caps, which have had relatively attractive valuations for some time.Moreover, while US stocks are becoming somewhat expensive, their foreign counterparts remain relatively cheap.

While we still have some exposure to large cap growth, and intend to continue participation in that area of the market, we are inclined to tilt towards value over growth, and towards small caps and developed international stocks over large caps. Within the context of a broadly diversified portfolio, we believe the runup in growth stocks leaves the door open for less trendy markets to narrow the valuation gap over the intermediate to longer term.

On the bond side, although the Fed may bump up rates a bit more, it appears the worst is over. Higher rates along with declining inflation may restore some of the luster bonds lost during the recent era of ultra low rates. We have also sought diversification in bonds via emerging market debt, as well as corporate credit, as these bond segments provide high income, though default rates, which are reasonable now, need continued monitoring. Floating rate bonds may have had their day in the sun, but the likely end of the Fed’s hiking cycle limits their upside. Down the road we may seek to add duration to portfolios in anticipation of the Fed cutting rates, but that time does not appear imminent.

Given the strong performance of equities and adequate performance of bonds so far in 2023, it appears that much of the good news (or, if you like, the absence of bad news) has likely already been priced in by markets. Going forward, steadily shrinking inflation under an umbrella of modest GDP growth could spark additional market gains, even more so if some of the promise of newer technology such as green energy and artificial intelligence find practical applications more quickly and lucratively than expected. On the other hand, if progress against inflation falters, the economy could dip into recession, and since the impact of tight monetary policy increases over time, we could be mired in a stagnant economy in which the Fed’s higher rates that seek to contain inflation would hobble the prospects for recovery. We don’t know what the future will bring, but as always, we advocate for portfolios that are well diversified so as to handle a variety of economic and market contingencies. Given the market’s concentrated gains thus far in 2023, the case for a diversified portfolio is bolstered for the second half of the year and possibly beyond.

—JMS Team

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC-registered investment advisor

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. Certain material in this work is proprietary to and copyrighted by Litman Gregory Analytics and is used by JMS Capital Group Wealth Services LLC with permission. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. Any references to future returns are not promises - or even estimates - of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation for a specific investment. Past performance is not a guarantee of future results.

With the exception of historical matters, the items discussed are forward-looking statements that involve risks and uncertainties that could cause actual results to differ materially from projected results. We have based these projections on our current expectations and assumptions about current and future events - as of the time of this writing. While we consider these expectations and assumptions to be reasonable, they are inherently subject to significant business, economic, competitive, regulatory and other risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond our control. There can be no assurances that any returns presented will be achieved.

‹ Back