By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

Statistical Quirks

Today we have easy access to massive amounts of financial data. Given that human beings are adept at seeing patterns, and have designed algorithms to harvest more patterns, it’s not surprising that companies can drill down and find streaks among the granules of data. Goldman Sachs has one such fun chart in their November market pulse:

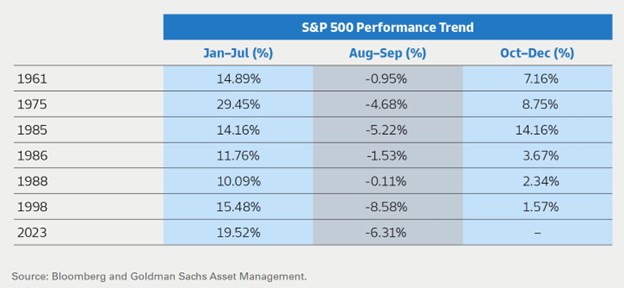

The chart displays years in which the S&P 500 gained at least 10% from January through July but then fell from August through September. It also includes subsequent performance in the final quarter of those years.

It’s a small sample size of six (with this year pending), so results should be taken with many grains of salt. Nonetheless, in every sample year the S&P 500 rose during the 4th quarter. It’s possible that there’s some cyclical explanation for a summer swoon followed by an autumn revival, but there’s an even simpler explanation—throughout its history, the S&P 500 has risen much more frequently than it has dipped. In the last 123 quarters of an index fund that tracks the S&P 500, the fund has posted gains about 75% of the time, as 92 quarters have seen positive gains, and 31 quarters have seen losses. If we randomly pick 6 quarters from the past 31 years, there’s a reasonable chance (better than 1 in 6) that all 6 quarters show the S&P 500 posting gains. It’s not clear there’s anything special about years that start strong but dip in late summer.

Still, the chart is a good reminder of the historical truth that markets have tended to rise over time. It can be tempting to rush to the exits after several down weeks but fear is not the best guide for investment decisions. We do have concerns about the S&P 500—its gains this year have been highly concentrated, its valuations are fairly high when compared to those of other markets, and it faces increased competition from bonds that now have much more competitive yields—but overreacting to two bad months risks missing out on better times, such as the past week, in which the S&P 500 has gained over 5%.

###

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. This material has been prepared for informational purposes only, and is not intended to be or interpreted as a recommendation. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice.

‹ Back