By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

Surveying the Market

What do fund managers expect for 2022? Bloomberg’s John Authers discusses a set of survey results on economic expectations for the upcoming year. The survey, conducted by David Bowers of Absolute Strategy Research Ltd., poses a number of questions to fund managers on key economic data. The bottom line, from the ensuing graphs, is that it appears managers are fairly confident that the Fed will be able to mitigate the inflation surge without overly hampering the economy:

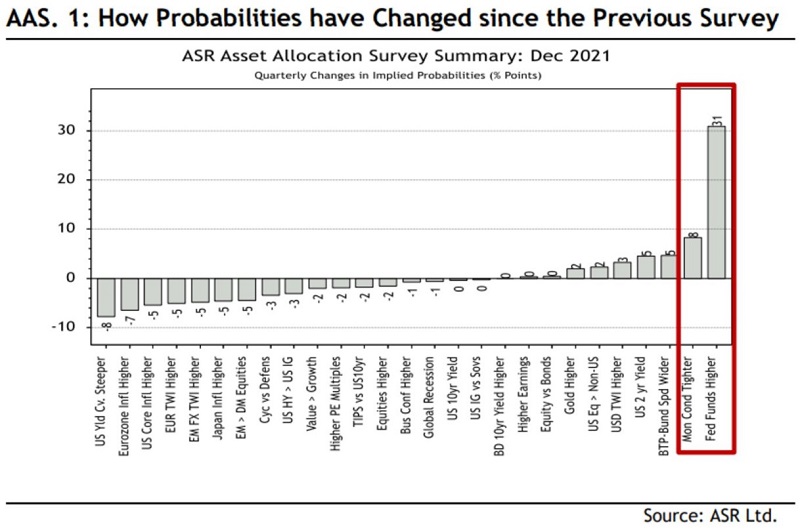

Rate hikes are anticipated, as they should be, given that the Fed has telegraphed that they are likely to occur this year.

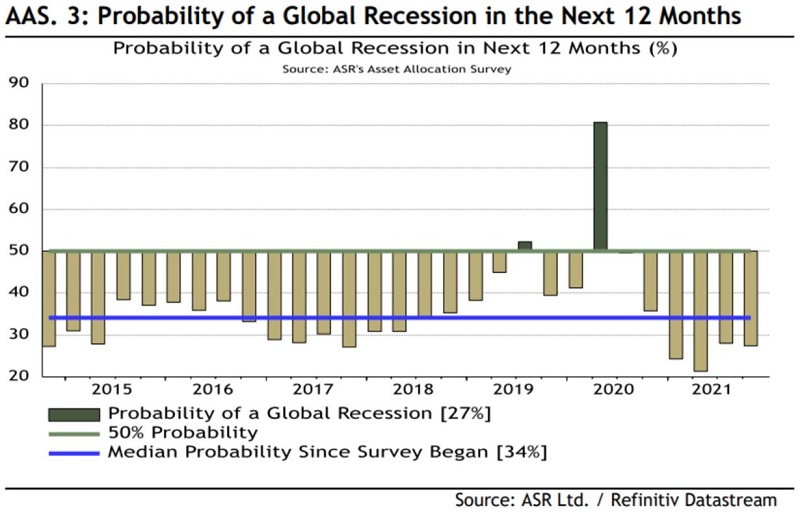

But fund managers also believe that central banks will be able to raise rates without inducing a recession. And as for inflation:

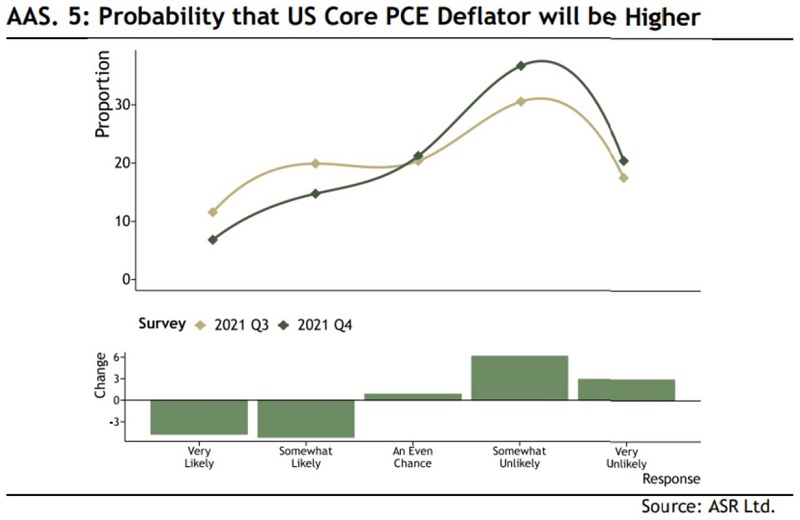

The majority of survey respondents, as shown by the right side of the graph, believe that inflation is either somewhat or very unlikely to be higher a year from now. Compared to the Q3 2021 survey, there is greater optimism that inflation will be contained; however, there is also a substantial minority that foresees inflation continuing to worsen this year.

The overall picture is general macroeconomic optimism, and unsurprisingly such optimism has translated in recent months into surging markets. Whether the Fed and other central banks can continue their balancing act, raising interest rates sharply enough to curtail inflation without curbing growth too much, remains to be seen. To this point, at least, central bank performance is getting largely positive reviews from the fund managers surveyed.

###

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. This material has been prepared for informational purposes only, and is not intended to be or interpreted as a recommendation. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice.

‹ Back

Comments