By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

The Fed – Back in the News Again

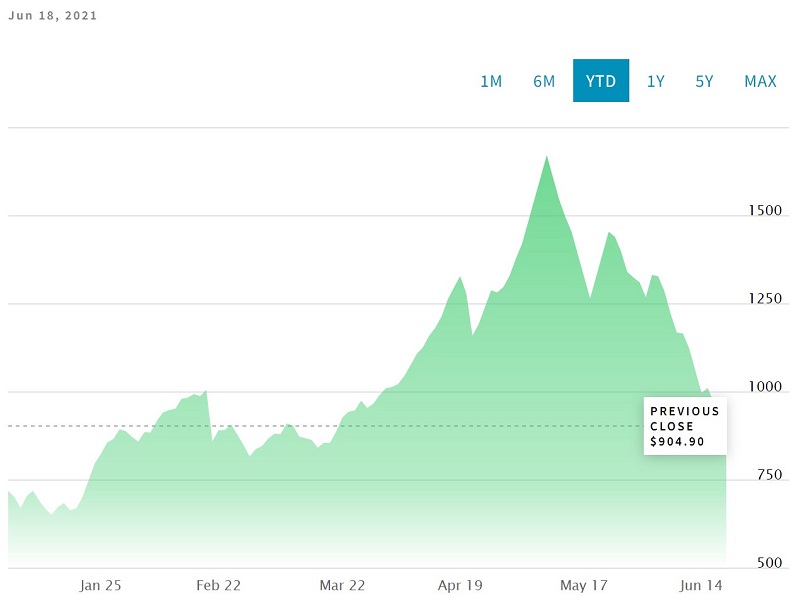

Lumber price surged this spring to record levels, spurring concerns about the Fed’s relative nonchalance towards inflation. Over the past few weeks, however, this story has changed in two ways:

Lumber (LBS):

Source: Nasdaq

Source: Nasdaq

First, lumber prices have fallen sharply, and while they’re still above historical norms, the quick rise and fall gives credence to the Fed’s argument that much of the inflation we have seen this spring is transitory in nature.

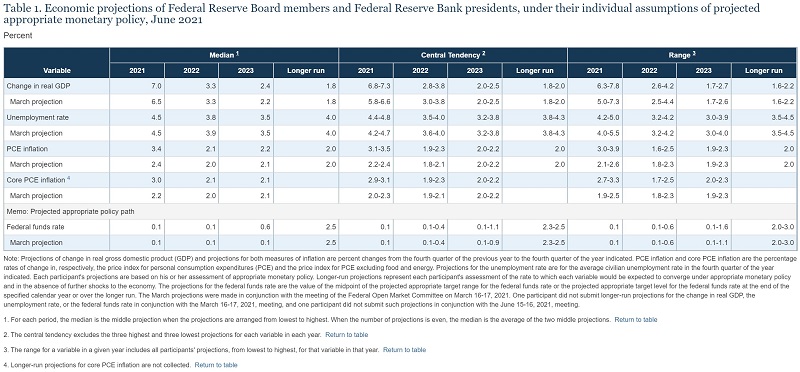

Second, the Fed has not had its head in the sand with respect to inflation bursts in 2021, as its new forecasts show:

Source: Federal Reserve

Source: Federal Reserve

The Fed’s updated projections show that it now expects the economy to run hotter, with higher inflation, than previously believed in March—the 2021 GDP forecast has shifted from 6.5% to 7.0%, while the 2021 inflation forecast has risen from 2.4% to 3.4%. And there’s slightly more hawkishness with respect to interest rate forecasts, as the median projection now shows 2 quarter point rate hikes in 2023.

Fed Chair Jerome Powell also indicated the Fed has begun considering scaling back its bond purchasing program, but there’s no timetable on if and when such a pullback would begin. Overall, the Fed continues to be in wait and see mode, as it continues to monitor inflation, unemployment, wage changes, and GDP. Given the unique nature of the pandemic-driven downturn and economic recovery, the Fed understandably is keeping its powder dry until it can obtain a clearer economic picture.

###

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. This material has been prepared for informational purposes only, and is not intended to be or interpreted as a recommendation. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice.

‹ Back