By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

A 2nd Quarter Projection

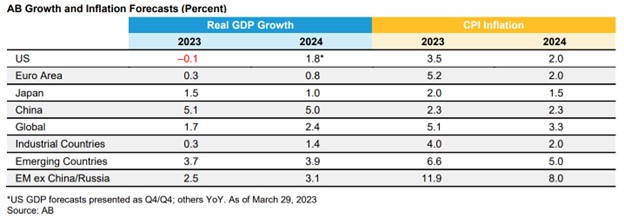

AllianceBernstein has issued its second quarter macroeconomic forecast for 2023. The most compelling line of the article is probably the first line, which argues that the 2023 outlook has become murkier rather than clearer as the year has unfolded. We’ve already been plagued by unexpectedly sticky high inflation, and on top of that we added a regional banking crisis in March which still poses at least some risk of financial contagion. Predictions should always be taken with a grain a salt, but perhaps an additional heaping is in order here.

The overall forecast is for slow growth amidst declining (but still elevated) inflation. Underlying assumptions are that the bank panic will remain contained, and that monetary policy will remain tight. The authors astutely note that banks are likely to become more conservative after Silicon Valley Bank’s failure, and that diminished credit issuance could have the silver lining of doing much of the Fed’s work for them by cooling the economy. The downside case, though unlikely, would be further stress in the banking system that results in a financial crisis, which would cross-pressure the Fed, as it would want to both help the economy recover and to cool the economy to stem inflation.

A warm winter helped Europe avoid an energy crunch, and a recession there appears less likely. However, persistent inflation and central bank tightening constitutes a significant headwind for that region. On the other hand, China’s reopening may enable it to post some catch-up growth post COVID. Other emerging markets have tightened monetary policy to fight inflation, but now also face the headwinds of a stronger dollar and a potential credit crunch stemming from fallout from the banking crisis.

Overall, AllianceBernstein argues for caution for investors, and not panic. This generally reasonable advice seems particularly appropriate now, with the bank panic only a month in the rear view mirror and the path of future inflation still highly uncertain. Markets should continue to recover over time, and economies are likely to curtail inflation, but how and when such events unfold continues to be murky.

###

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. This material has been prepared for informational purposes only, and is not intended to be or interpreted as a recommendation. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice.

‹ Back