By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

A Case for Corporate Bonds

AllianceBernstein’s Tiffanie Wong and Timothy Kurpis make the case for investment-grade corporate bonds. While the macroeconomic backdrop contains uncertainty as to the path of inflation and growth in the near term, they argue that high quality corporate bonds have significant appeal.

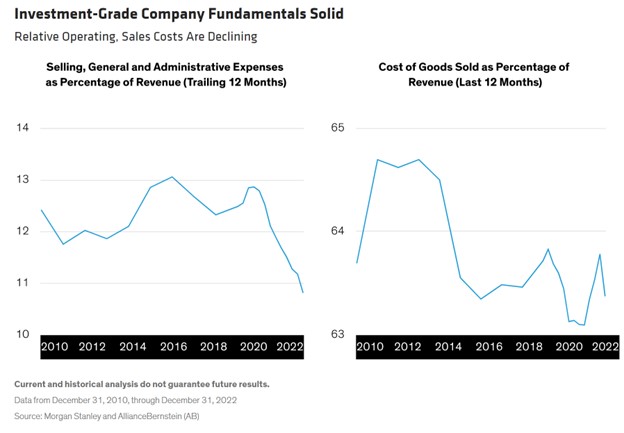

Earnings and growth may be cooling, but they are both coming down from a relative peak. Companies are also keeping their relative costs in check:

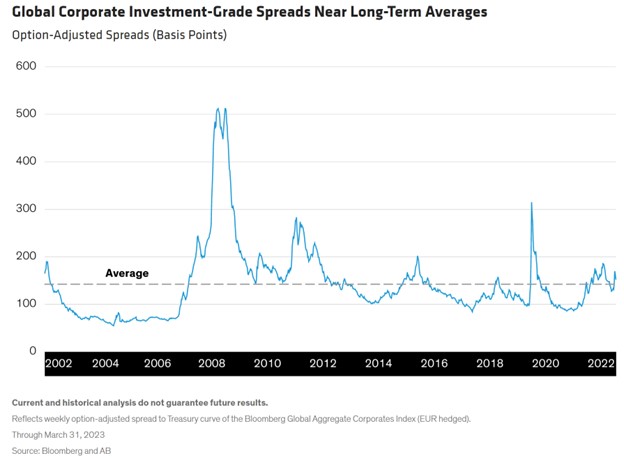

Wong and Kurpis note that companies have also been doing better than their historical averages of paying their debts, and that much of corporate debt was locked into lower yields, so that the impact of higher rates will take longer to be felt. They also argue that prices for US-dollar and Euro-denominated investment grade corporate bonds are at their lowest since the financial crisis, largely due to higher interest rates, while global credit spreads between investment-grade corporate and government bonds yields are above average:

The authors view high-quality corporate bonds as a defensive measure to buttress portfolios against macroeconomic fluctuations. With strong fundamentals, attractive valuations, and positive asset flows, investment-grade corporate bonds may constitute an opportunity for portfolios to provide income under an appealing risk-reward profile.

###

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. This material has been prepared for informational purposes only, and is not intended to be or interpreted as a recommendation. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice.

‹ Back