By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

EVs are Taking Over

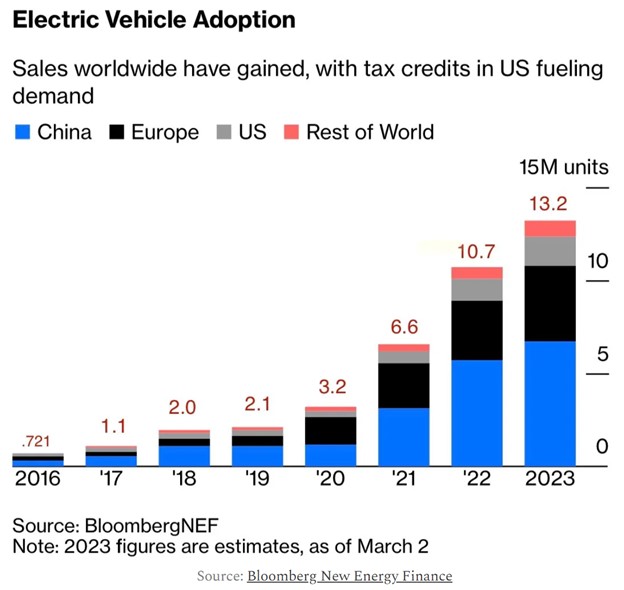

Noah Smith documents the massive increase in electric vehicle (EV) sales and compellingly argues that the potential hurdles to a continued surge are likely to be cleared. In fact, EV sales growth has been exponential:

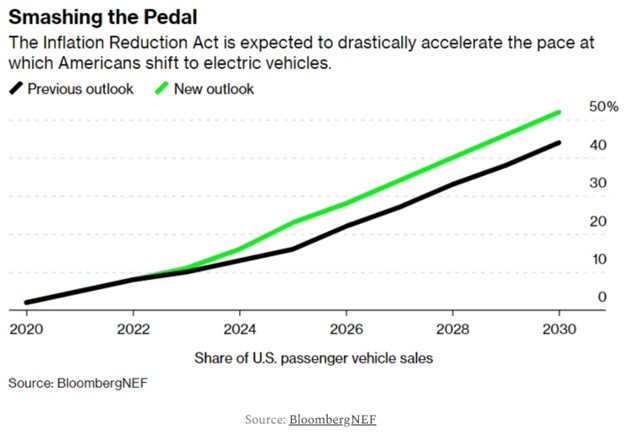

Over the past 7 years EV sales have increased by a factor of 18, typically more than doubling every 2 years. Projected growth is also extremely high, as Smith demonstrates:

EV’s share of US passenger vehicles is expected to rise from near 0% to over 50% in ten years. Smith also notes that Europe and China are ahead of the US in EV adoption.

How is this possible? Smith cites technological advances as the primary driver of EV growth. Lithium-ion batteries have become more energy dense, while their prices have fallen over 97 percent since 1990. Though EVs have environmental benefits relative to gasoline-powered automobiles, Smith believes that the primary reason for an EV takeover is that EVs can simply outcompete internal combustion engine vehicles via lower costs.

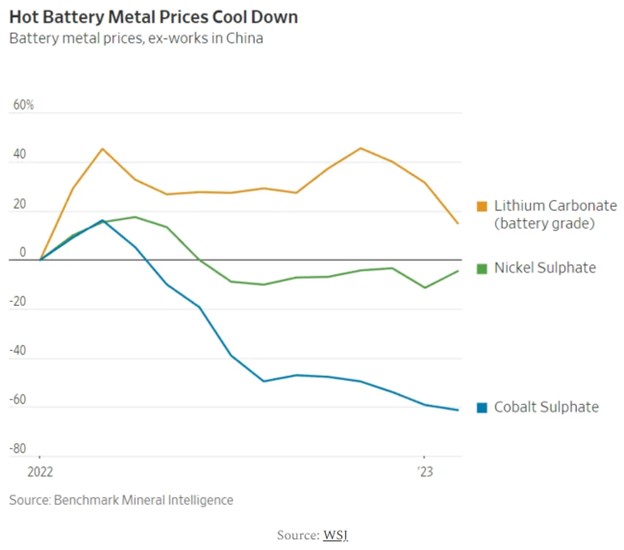

Smith also addresses sources of skepticism about EVs. The median EV range has increased from 73 miles in 2011 to 247 miles in 2022, and range is expected to continue to grow. Mineral shortages are potentially a severe headwind, but Smith points out that higher prices incentivize manufacturers to find cheaper substitutes:

Higher mineral prices also motivate companies to expand mining capacity, seek out additional reserves, and further develop extraction technologies. In other words, people and markets adapt to limit the impact of a potential resource shortage. Given its foothold in automotive markets and projected growth, the future of electric vehicles appears to be the story of a new technology displacing an old technology.

###

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. This material has been prepared for informational purposes only, and is not intended to be or interpreted as a recommendation. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice.

‹ Back