By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

How Did Forecasters Miss Inflation?

In twenty years economists may sagely nod with the wisdom of hindsight and argue how 7% inflation and 5% core inflation in 2021 were inevitable given constrained supply and stimulated demand. But if you step back and look at economic forecasts last spring, you may wonder if people were more likely to predict a Rams-Bengals Super Bowl than 7% inflation in 2021. Ex-Council of Economic Advisors Chair Jason Furman looks back at inflation predictions and tries to understand what went wrong.

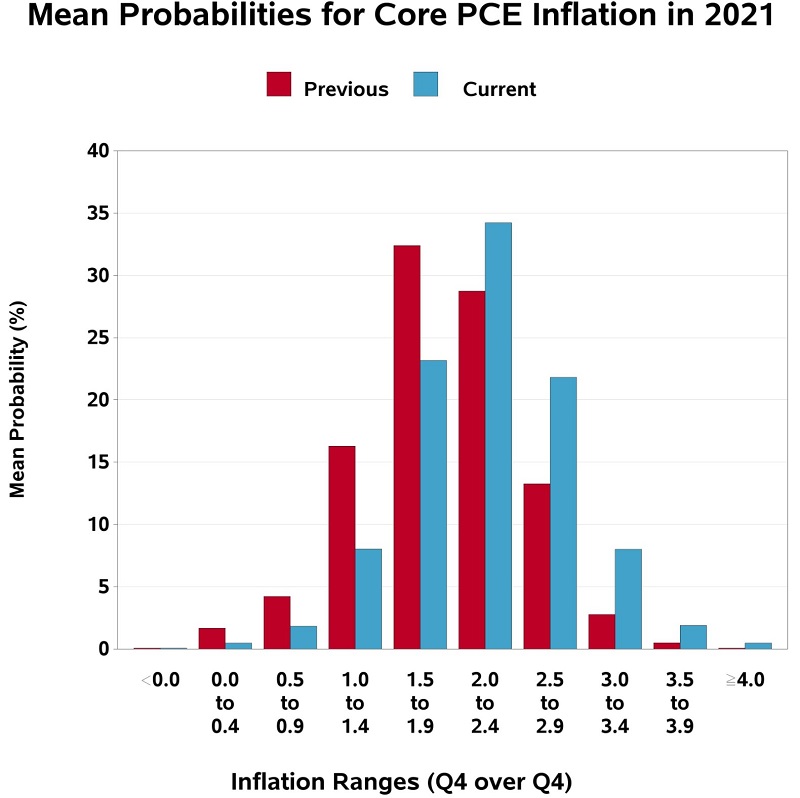

First, the list of those who underestimated 2021 inflation is broad, and includes the Federal Open Market Committee, the International Monetary Fund, the Congressional Budget Office, the Biden Administration, financial markets (using implicit predictions via bond prices), and a Philadelphia Fed survey, published last May, of 36 private-sector forecasters. Of 18 FOMC members, as of March, 2021, none predicted a core inflation rate above 2.5% for 2021, and the range of predictions was narrow, ranging from 1.9%-2.5%. The Philadelphia Fed survey gives not only a median estimate for inflation (about 3% for headline inflation, 2.1% for core inflation), but also probability estimates:

Source: Philadelphia Fed

Source: Philadelphia Fed

The professional forecasting assessment last spring was that there was a less than 1% chance that 2021 core inflation would be 4% or more—and we ended up at almost 5%.

How did nobody see this coming? Furman considers several possibilities. The coronavirus delta variant may have slowed production, but it also likely inhibited demand, and Furman argues that the delta variant more likely reduced than increased inflation. Supply chain issues are probably a piece of the puzzle, as they caused bottlenecks in certain sectors, but nonetheless domestic and international manufacturing and shipping rose sharply.

Furman’s main argument is that economic modeling was not taken seriously enough. Given inflation had been low and steady for decades, the natural forecast would be to assume that low inflation would continue, as it probably would have, absent extraordinary circumstances. Of course, $2.5 trillion in US fiscal support in 2021 is an extraordinary circumstance, as it was the largest support package (relative to GDP) since World War II. Such spending would be likely to increase demand while COVID could limit the productive capacity of the global economy.

Hindsight is 20/20, but Furman also looks to apply his mental economic model to 2022. His estimate is that high demand, constrained supply, tight labor markets, and higher inflation expectations will lead to elevated inflation in 2022, with services inflation likely increasing and goods inflation likely declining. His guess is that inflation will be in the 3-4% range in 2022, but acknowledges that given these extraordinary economic times, the error bars on his prediction are high, updating forecasts as new data emerges is critical, and humility when making forecasts is a necessity.

###

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. This material has been prepared for informational purposes only, and is not intended to be or interpreted as a recommendation. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice.

‹ Back

Comments