By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

Stocks and Yields

The rise in yields has made fixed income a more attractive investment opportunity. But to what extent does the increased appeal of bonds mean that stocks are less enticing? AllianceBernstein’s Walt Czaicki, David Wong, and Robert Milano look at the history of the equity risk premium to assess this question.

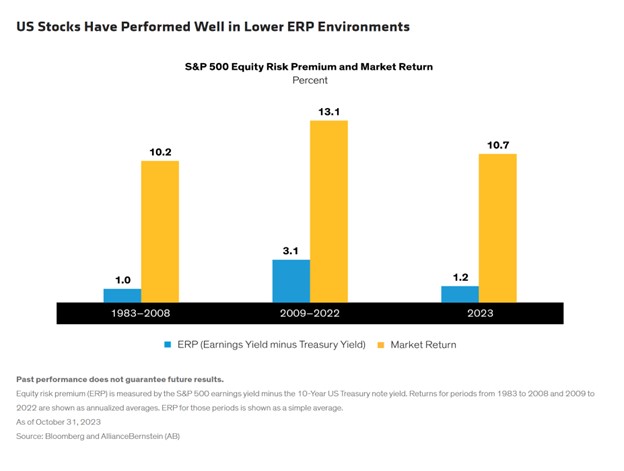

The equity risk premium is the excess return over the risk-free rate that is expected by investors for putting their money into stocks. Czaicki, Wong, and Milano measure the equity risk premium by taking the earnings yield of the S&P 500 and subtracting the 10-year US Treasury yield. Not surprisingly, as yields have risen over the past 2 years, the equity risk premium has shrunk from 3.1% to 1.2%:

The ultra-low rates of the 2010s dovetailed with a higher equity risk premium, and higher overall returns to the S&P 500. Still, as the authors note, the equity risk premium of 1983-2008 was also low, yet stocks rewarded investors with an annualized 10.2% return over that period. Admittedly, bonds have become more relatively attractive, and there’s no guarantee that equities will continue to build on their 2023 gains over the coming years. Still, while higher bond yields (if they last) could correspond with a slowing of equity returns, we would be reluctant to bet too heavily against US stocks, given that the S&P 500 has a long history demonstrating the tendency of equities to rise over time, and under a variety of market conditions. Instead, relying on a balanced portfolio which pockets higher bond yields while seeking to take advantage of areas of value within stocks seems prudent.

###

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. This material has been prepared for informational purposes only, and is not intended to be or interpreted as a recommendation. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice.

‹ Back