By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

The 60 / 40 Portfolio

Ben Carlson reviews the history of the 60/40 portfolio of US stocks and bonds. Not surprisingly, given the downturn in equities last year and the historically bad year for bonds, the 60/40 portfolio, comprised of the S&P 500 and 10 year Treasuries, did not fare well in 2022:

Last year was the worst in 85 years—worse than the 2008 Financial Crisis, and worse than the 2001-2002 Dot-Com Bubble bursting.

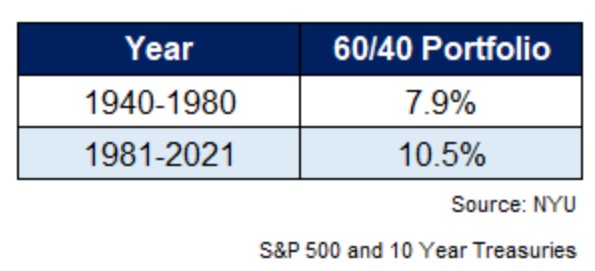

Still, despite being a very bad year, 2022 was an outlier. It’s just the 5th time in the past 95 years that stocks and bonds both fell in the same year. Carlson notes that some financial writers have been trying to bury the 60/40 portfolio for years, and that obviously 2022 provides further ammunition for such views. Nonetheless, over longer time horizons, the 60/40 portfolio still holds up quite well—even including the disastrous losses in 2022, Carlson observes that annual returns were 7.7% from 2013-2022. And while the 60/40 portfolio likely benefitted from declining inflation and falling interest rates over recent decades, its previous performance was also solid:

While future returns are obviously unknown, increased bond yields put the fixed income component of a 60/40 portfolio in a better starting position, potentially easing the pressure on stocks. While the above tables include only domestic investments, most modern portfolios are more broadly diversified, with additional components such as foreign stocks and bonds, emerging market stocks and bonds, small caps, mid caps, real estate, and more. Carlson lists a variety of media predictions about the impending doom of the 60/40 portfolio, but argues that dismissing it is nonsensical and akin to dismissing diversification altogether. While a balanced, diversified portfolio may be vanilla, it’s worth remembering that vanilla is the world’s most popular ice cream flavor.

###

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. This material has been prepared for informational purposes only, and is not intended to be or interpreted as a recommendation. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice.

‹ Back