By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

The Electric Vehicle Market

JPMorgan’s annual energy report, written by Michael Cembalest and found at https://am.jpmorgan.com/content/dam/jpm-am-aem/global/en/insights/eye-on-the-market/future-shock-amv.pdf, gives an interesting perspective on the state and future of the electric vehicle market. While electric vehicles (EVs) are an increasing share of the vehicle market, the time required for the EV stock to replace the internal combustion engine (ICE) vehicle stock may be quite long.

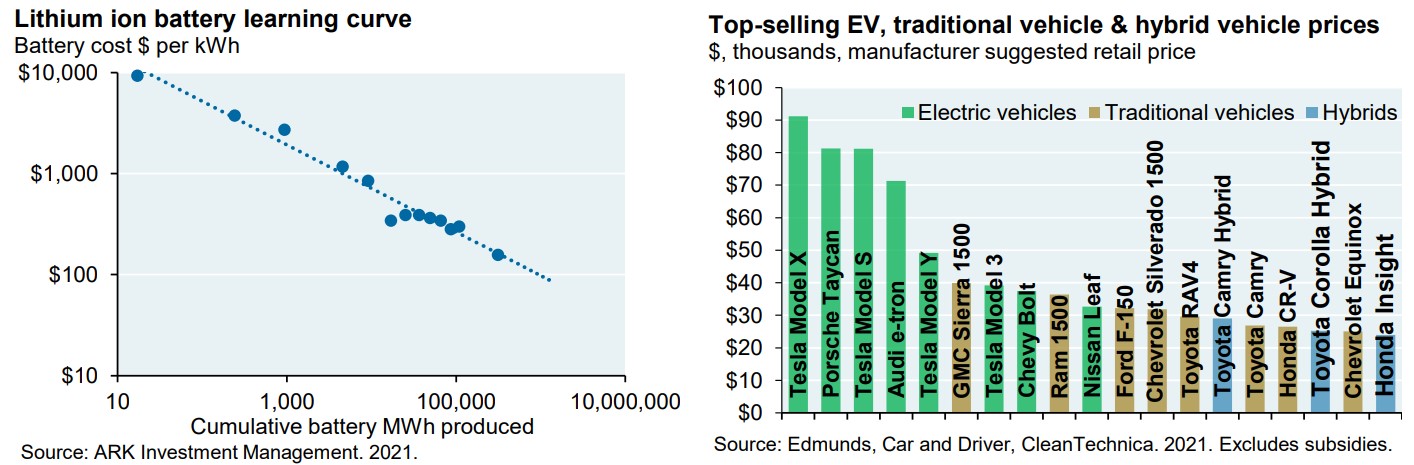

The good news for electric vehicle manufacturers is that battery costs have been plummeting over time, and that the cost of electric vehicles may soon achieve parity with the cost of ICE cars:

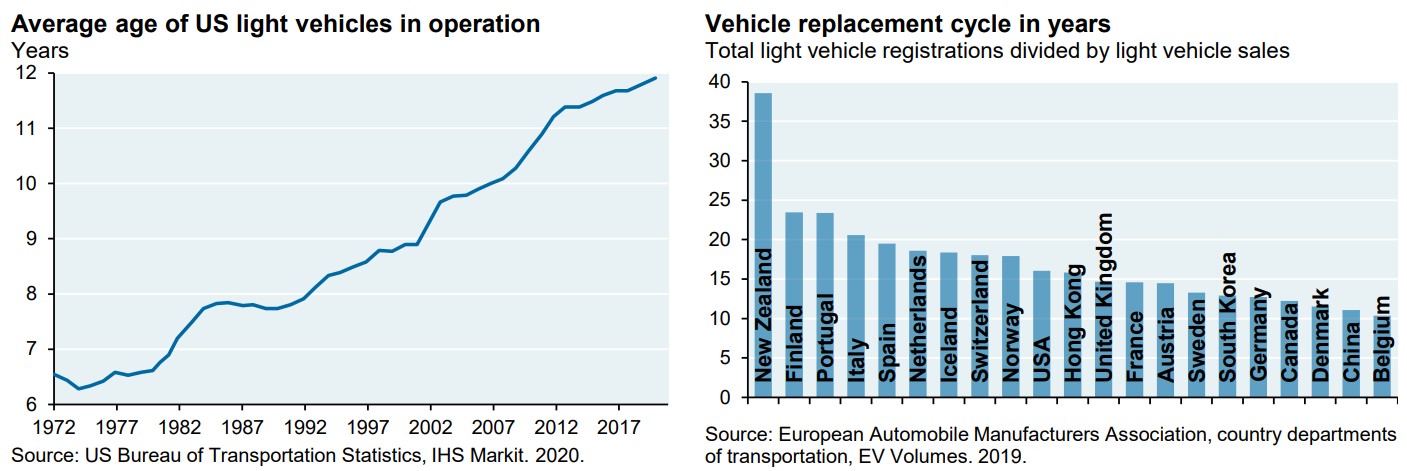

However, Cembalest observes several factors that are likely to slow the impact and adoption of electric vehicles. First, cars simply last longer than they used to. Obviously this fact is great news for consumers but it will also slow the changeover to EVs.

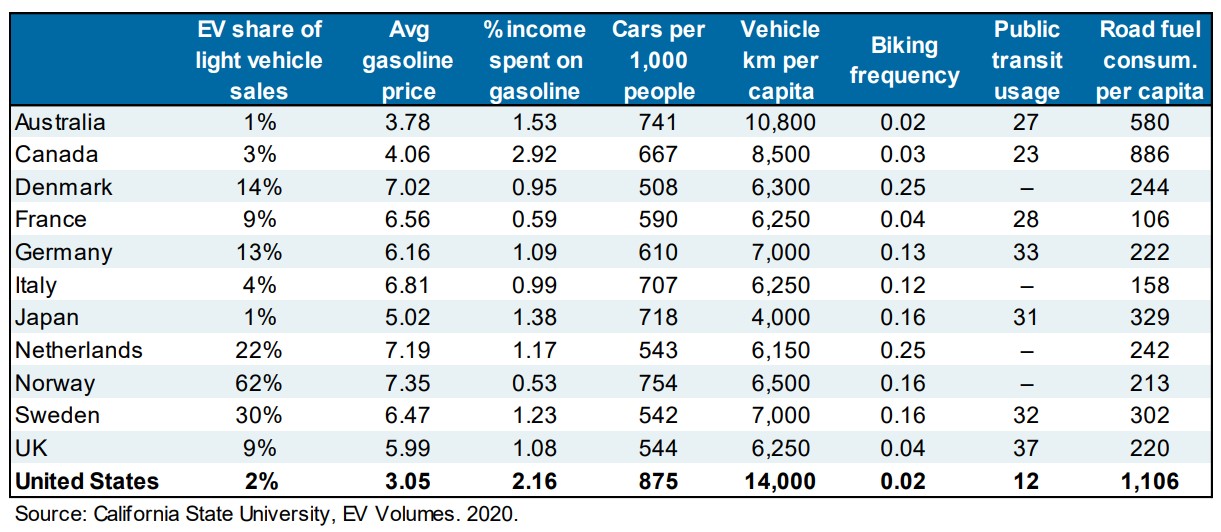

Second, EVs are still such a small share of the US and global market that it will likely take a number of years for EVs to outsell ICE cars:

With the exception of Norway, which has an abundance of hydroelectric energy and highly preferable tax treatment for EVs, most countries have an EV share of light vehicle sales below 15 percent. The United States, with the most cars per 1,000 people and most vehicle km driven per capita, has an EV share of sales of only 2%. While that number is expected to increase over time, the current baseline is low.

Finally, the cost of electric SUVs and light trucks has lagged behind the cost of ICE comparables. EV costs would need to continue to fall in order for electric vehicles to move out of their niche into the broader market. There are promising signs with respect to EV truck costs—since the JPMorgan analysis was published, Ford released new details on its F150 Lightning EV pickup, and as described at https://www.motortrend.com/news/2022-ford-f-150-lightning-electric-truck-price-msrp/, the price gap between the EV and ICE version has narrowed considerably, even before considering any EV tax credits or incentives.

Overall, it is reasonable to expect electric vehicles to largely supplant ICE vehicles in the long run. What the JPMorgan analysis emphasizes is that the transition is likely to be gradual. Change takes time. A CDC review at https://www.cdc.gov/motorvehiclesafety/pdf/policyimpact-seatbelts.pdf noted that even for a modest behavioral change such as wearing seatbelts, it took almost 30 years for seatbelt usage to rise from 11% in 1981 to about 85% by 2010. A revolution in the auto market will take time as well.

###

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. This material has been prepared for informational purposes only, and is not intended to be or interpreted as a recommendation. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice.

‹ Back