By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

Are We in a Recession?

The Q2 2022 GDP report came in last week and GDP fell for the quarter, as it did in Q1 2022. Does this mean we’re in a recession? Officially, no. The National Bureau of Economic Research (NBER) is the arbiter of recession, along with their start and end dates, and they have yet to come to a conclusion on this matter, and may not do so for some time. There is, however, a rule of thumb on recessions, first invented in 1974, that states that a recession has occurred whenever there are 2 consecutive quarters of negative real GDP growth. Like many rules of thumb (can we have a rule of thumb about rules of thumb?), it is generally accurate but prone to exceptions—recessions can occur without back to back quarters of negative GDP growth, as happened in 2020, and back to back quarters of negative GDP growth do not always indicate a recession, though the last counterexample was in 1947.

The term recession, unfortunately, has become a sort of buzzword for political branding—Republicans are yelling recession to portray Biden as presiding over a stagflation economy, while Democrats are denying this label. Whether we are technically in a recession is less important than the depth and breadth of the recession, just as suffering from COVID could mean anything from a few sniffles to a life-threatening illness.

Economist Noah Smith surveys 3 definitions of recession as he argues that recessions should be viewed in a larger economic context. The NBER definition looks at a variety of measures of economic activity in order to determine, usually well after the fact, whether the decline in activity was sufficiently long and deep enough to merit the recession label. It’s a fuzzy definition, and more useful as a historical marker than as a nowcast of the state of the economy. The folk definition is more clear and simple—it’s that 2 consecutive quarters of negative real GDP growth equals a recession. The third definition that Smith cites is an academic definition, involving the economy growing at a subpar pace relative to trend—and of course, determining what’s the trend and what’s the fluctuation around the trend is the challenge.

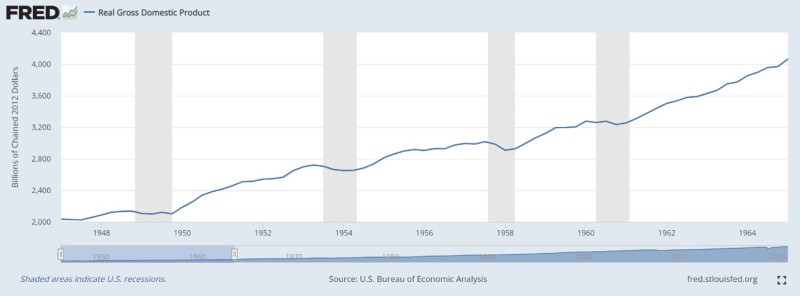

But whether we’re in a recession or not (and Smith believes we are) is less important than the larger context around the trend. In the 1950s, the US economy suffered through 4 recessions, but they were mild in an era of strong growth:

The context to our current economic situation is that the US economy faces a serious threat in high inflation. In order to address this problem, the Fed is raising rates in a deliberate attempt to cool the economy. The ideal outcome would be lower inflation without a recession, but economics is typically full of tradeoffs. Nobody wants to see an early 80s or a 2008-type recession, but if raising rates can cure inflation with only the side effects of a mild recession, then the Fed’s path would likely be economic medicine worth taking.

###

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. This material has been prepared for informational purposes only, and is not intended to be or interpreted as a recommendation. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice.

‹ Back