By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

Current Inflation Expectations

7% inflation is bad, but the even more critical issue is whether this high rate of inflation is likely to dissipate or to stay with us for a long time. To the extent that inflation expectations can drive inflation--if firms and workers anticipate higher inflation, they may raise prices or demand higher wages more readily, thus making theoretical inflation a reality)-- consumer beliefs about future inflation may tell us about inflation’s possible path, and how much time we may have to alter that path.

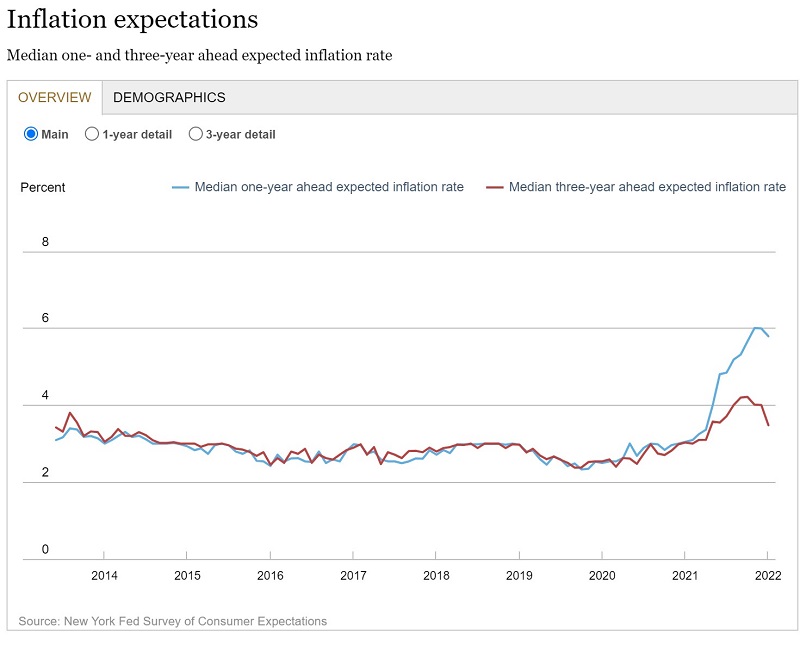

The New York Fed has just released the January 2022 Survey of Consumer Expectations, which contains the following chart with respect to inflation expectations:

There are two noteworthy items about the January survey. First, for the first time in over a year, inflation expectations have declined—in the short term from 6.0% to 5.8%, and the medium term from 4.0% to 3.5%. Second, there is a clear divergence between 1-year and 3-year inflation expectations that has emerged since inflation started spiking in 2021. Consumer perception is that the inflation surge is still a relatively transitory phenomenon, perhaps the product of this weird pandemic era, with Covid, fiscal, and monetary shocks reverberating through the economy.

There are two noteworthy items about the January survey. First, for the first time in over a year, inflation expectations have declined—in the short term from 6.0% to 5.8%, and the medium term from 4.0% to 3.5%. Second, there is a clear divergence between 1-year and 3-year inflation expectations that has emerged since inflation started spiking in 2021. Consumer perception is that the inflation surge is still a relatively transitory phenomenon, perhaps the product of this weird pandemic era, with Covid, fiscal, and monetary shocks reverberating through the economy.

We’ll need more data to see whether the January drop in inflation expectations continues or whether this was a one-time occurrence. The gap between short and medium inflation expectations has been more durable, and so at this point it appears that the Fed still has time to bring inflation and inflation expectations closer to their longer-term norms. We shall see whether the Fed can take advantage of its current window to tame inflation before it can become entrenched.

###

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. This material has been prepared for informational purposes only, and is not intended to be or interpreted as a recommendation. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice.

‹ Back