By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

Diversified - Emerging Markets

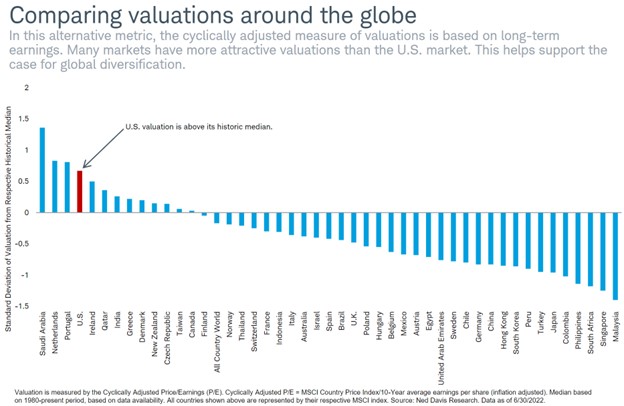

A diversified portfolio typically includes some degree of investment in emerging markets. Schwab’s quarterly chart book has a nice metric showing the relative appeal of foreign investments:

Malcolm Dorson, Paul Dmitriev, and Trevor Yates of Mirae Asset Global Investments observe that the recent rise in the dollar has hurt emerging market performance, since emerging market debt is usually in dollars. Their hope is that this historical relationship will hold, so that if the dollar weakens, emerging markets will benefit:

They also point out that in recent years, a US rising rate environment has tended to be followed by slower growth, less central bank activity, and a weakening dollar, and that emerging markets have been able to take advantage:

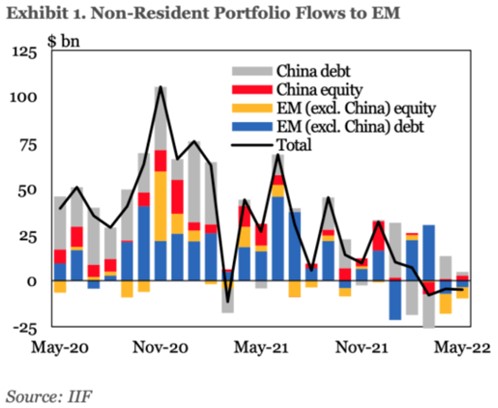

The sample size is only 3, however, with the Fed conducting rate hikes in 1999, 2004, and 2015. Emerging markets also exhibit fairly high volatility, so an increased outlay to that area of the market would likely make portfolio performance a bit more of a bumpy ride. It’s also worth noting that capital flows have not been kind to emerging markets in recent months:

With Russia’s invasion of Ukraine, inflation, supply chain challenges, COVID disruptions in China, and concerns about China’s stance towards Taiwan, there are several issues challenging many emerging market economies. After the bear market in the first half of 2022, several asset classes, including US equities, developed international stocks, and emerging markets stocks, now have more attractive valuations. We appreciate the case for emerging markets, and believe them to be a useful component of portfolios; while we wouldn’t put too much weight on a sharp post-rate-hike rebound (though it could happen), we do believe that emerging markets are likely to bounce back over time, and as such can be a useful holding over the longer term.

###

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. This material has been prepared for informational purposes only, and is not intended to be or interpreted as a recommendation. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice.

‹ Back