By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

EM and ESG

As emerging economies grow, their markets may increasingly resemble those of developed markets. An AllianceBernstein analysis by Christian DiClementi and Patrick O’Connell reviews EM (emerging markets) corporate bonds from an ESG (Environmental, Social, and Government) framework, arguing that the differences between developed markets and EM bonds may have been exaggerated.

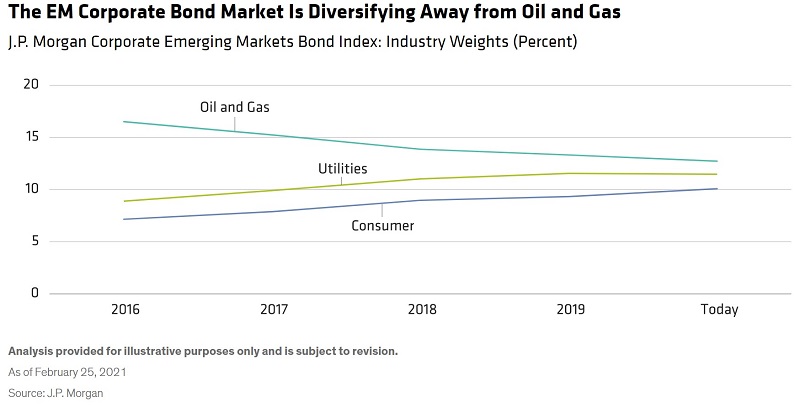

From this ESG perspective, the piece notes that even in the last few years, there has been a shift in emerging market bonds from the oil and gas sector to the utilities and consumer sectors:

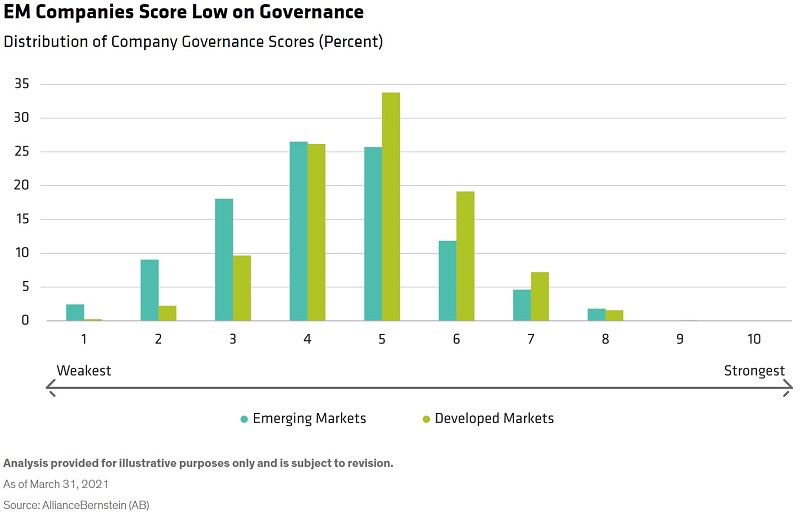

Moreover, from a governance standpoint, the differences are not stark, though there clearly are still differences:

Finally, the authors make the case for ESG as a useful assessment tool, describing their research that found that ESG challenges were at the root of about two thirds of underperforming EM corporate bonds over the past ten years.

Although EM and ESG concepts are relative youngsters in the investment world, they may gain increasing relevance over time. Emerging markets are already a component of a diversified portfolio, while ESG analysis, if able to delineate between strong and weak companies, would comprise a useful means of evaluating investments.

###

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. This material has been prepared for informational purposes only, and is not intended to be or interpreted as a recommendation. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice.

‹ Back

Comments