By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

Inflation Expectations

The main rationale for optimism about the future path of inflation is that longer-term inflation expectations are still anchored reasonably close to the Fed’s 2% target. The post Ukraine invasion shift in inflation expectations hints that such optimism may be overstated. Moreover, there is also the question of how inflation expectations are determined in the first place. Economist Jason Furman examines this question, as well as possible Fed rate hike pathways that seek to bring inflation to heel.

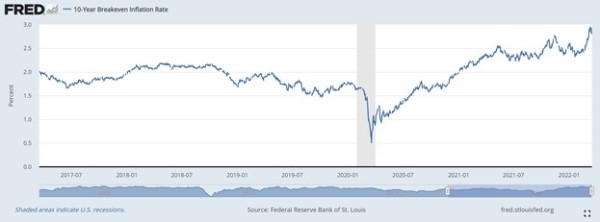

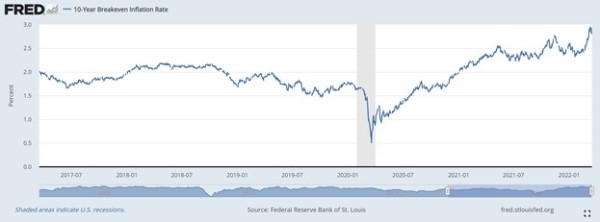

The 10-year inflation rate, which is a market-derived measure of the expected inflation rate for the next decade, on average, was quite stable pre-pandemic at about 2%. It fell at the onset of the COVID recession, moved above its recent average when inflation started spiking in 2021, but then stabilized at about 2.5% by the end of the year. Unfortunately, Russia’s invasion of Ukraine, which brought a rise in oil prices and major economic sanctions, has darkened the inflation picture further, and the recent drop in oil prices may be countered by the lockdown-causing resurgence of COVID in China. So, inflation expectations for the next decade are now nearing 3%.

Why is this important? As Furman notes, economic modeling of inflation typically has 3 components. One piece is simply an error term, which can reflect unexpected shocks, such as a pandemic or war. The second piece involves the difference between the unemployment rate and the ‘natural’ rate of unemployment—if the economy is running hot, so that the unemployment rate is unusually low, then inflation will tend to run higher. However, this inflation component has historically had only a modest impact—if the natural rate of unemployment is 4%, and unemployment is currently 1%, then the inflation rate would typically be less than 1% higher. The final component of inflation is expected inflation, which is both hugely important and poorly understood.

Source: TradingEconomic

Source: TradingEconomic

Why did the United States have a sustained inflation rate of under 5% for most of the 1950s and 1960s, then a rate averaging over 8% from the early 1970s to the early 1980s, followed by a rate rarely exceeding 5% for the next 40 years? Inflation rates in other countries can run much higher—Brazil had inflation rates of over 100% every year from 1981-1994; more recently, Argentina has had inflation of over 20% for each year from 2017 to 2021.

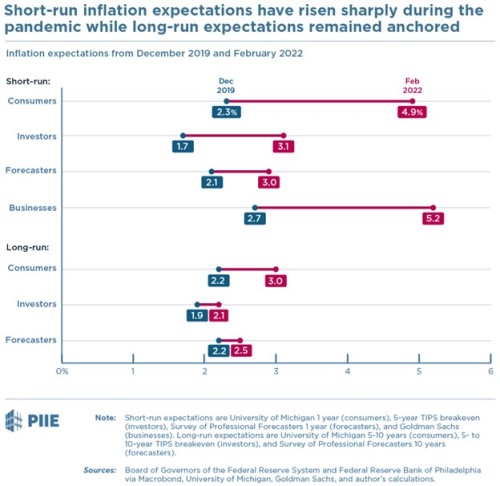

The economic model that presumes low expected inflation has worked quite well for the United States over the past 40 years; the question today is to what extent the world has changed. Furman writes that short-run fluctuations in consumer inflation expectations have not been very predictive, but today there is a notable gap between short-term and long-term views:

Is the recent inflation spike going to pull up longer-run expectations over time? Or will inflation expectations, likely with assistance from Fed policy, pull back to more historical levels? Furman addresses sources of inflation and inflation expectations, other factors that could raise or lower inflation over the coming year, and possible monetary policy pathways the Fed could choose; this will be the subject of a future post.

###

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. This material has been prepared for informational purposes only, and is not intended to be or interpreted as a recommendation. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice.

‹ Back