By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

Oil = Nickel

While many long-term ramifications of the Russian invasion of Ukraine are murky, one clear short-term consequence has been a sharp increase in oil prices. Crude oil futures rose to over $130 this week, reaching its highest point since 2008. Gas prices in America have also risen to a record high in nominal terms. These prices may stay high, as the United States is now expected to announce a ban on Russian oil imports.

The price of oil is determined on the global market, so the United States has a limited ability to affect current prices. Rick Newman argues that the idea of energy independence within a global economy is currently more mythology than a plausible reality. When a supply shock hits one country, all countries are affected by the ensuing increased oil prices; most countries, with the possible exception of Saudi Arabia, simply don’t have the production capacity to fully cover domestic consumption. Increasing domestic oil production can certainly help at the margins, but doing so will take time, and companies may be reluctant to invest in new wells unless they feel that selling prices will stay high.

In the longer run, renewable energy has greater potential to yield energy independence. Besides the health and climate benefits, cleaner energy could also reduce oil dependency on a number of countries with problematic governance, such as Russia, Iran, Saudi Arabia, or Venezuela. Growth in the electric vehicle market would be one way to reduce oil demand.

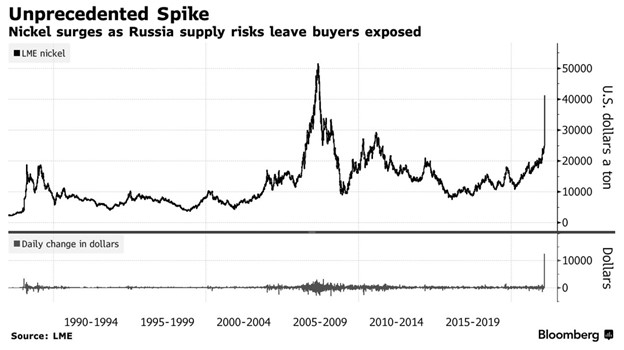

However, as mentioned, we live in an interdependent global economy. In order to produce more electric vehicles, more raw materials are needed. Specifically, one important component of electric vehicles are batteries, and these batteries contain nickel. You might be able to guess what’s happened to nickel prices recently:

Moreover, a high-purity “Class 1” form of nickel is particularly suitable for batteries, and while Russia only supplies 6% of nickel globally, it supplies about 17% of “Class 1” nickel. So efforts to reduce our dependence on Russian oil may lead us to increase our dependence on Russian nickel. Although Russian and Ukraine are bearing the brunt of this conflict, the effects of the war in an interconnected world may be broad and persistent.

###

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. This material has been prepared for informational purposes only, and is not intended to be or interpreted as a recommendation. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice.

‹ Back