By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

Interest Rate Normalization

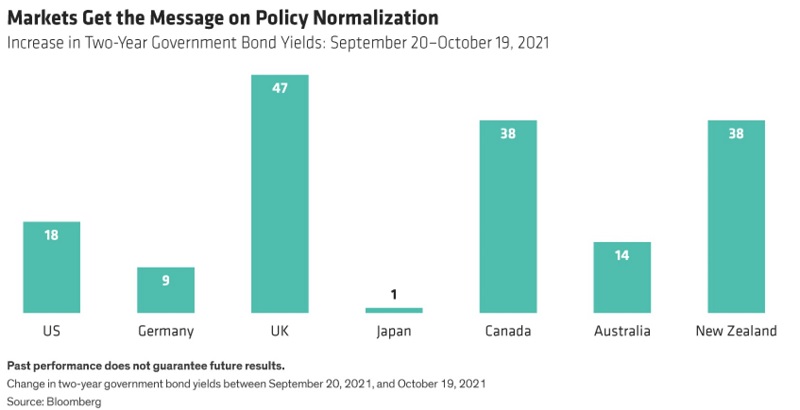

After its November 3rd meeting, the Fed is expected to announce a tapering of its asset purchase program, thereby initiating a transition back to using interest rate adjustments as its primary monetary policy lever. Eric Winograd at AllianceBernstein notes that the Bank of England meets on November 4th, and may then signal its intentions to raise interest rates. Given the worldwide economic turbulence caused by COVID, we would expect rate normalization to consist of baby steps, as central bankers continue to gather data about unemployment and inflation. Nonetheless, the past month has indicated that markets are anticipating future rate hikes, albeit relatively small ones.

Winograd argues that central banks are attempting reflation under both fortunate and trying circumstances. The good news is that economic recovery has progressed to the point that many economies no longer need such dovish monetary policy. The concerning news is that commodity and supply chain challenges have yielded inflation that is expected to persist for at least a few more months, and central bankers may be concerned that consumer expectations of inflation may rise to the point that higher inflation becomes a self-fulfilling prophecy.

That said, the bond yields chart above that Winograd cites is hardly predicting drastic action:

The current 2-year Treasury yield, for instance, was 0.48% as of October 22nd; the 2-year Treasury yield at the start of 2019 was 2.50%. Analysis of futures markets gives an expectation that the US will raise interest rates by only about 0.50% over the next year.

It's possible that markets could get a little more volatile if rates begin rising, though given that a 0.50% change isn’t much, and that markets are already pricing rate hikes in, markets may just take the change in stride. Though rates are likely to remain quite low by historical measures for the medium term, by initiating rate normalization, central banks may provide themselves more future flexibility, so that they can raise rates from a higher baseline should inflation data become alarming, or lower rates again should further economic support be deemed prudent.

###

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. This material has been prepared for informational purposes only, and is not intended to be or interpreted as a recommendation. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice.

‹ Back

Comments