By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

Jackson Hole – The Dovish Case

Fed Chair Jerome Powell’s August 26th speech at Jackson Hole made clear the Fed’s intention to bring inflation to heel, even at the cost of significant economic pain. Powell repeatedly argued for the necessity of continued forceful action now, lest inflation become more deeply rooted. Sacrifice was a theme, with a “no pain, no gain” ethos emphasizing the likelihood of an extended period of tighter monetary policy, below-trend growth, and softening labor markets.

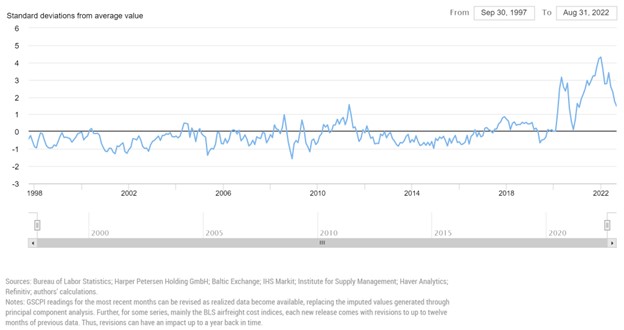

However, economists Joseph Stiglitz and Dean Baker argue that Powell and the Fed should forego the expected 75 basis point rate hike later this month, and wait until more data arrives to better assess the inflation, unemployment, and macroeconomic picture. Their argument is that recent inflation reports have shown significant improvement, and that many of the supply side factors that caused inflation to shoot up are now receding. This view echoes Powell’s previous thinking that inflation would be largely transitory—except that in this case, it’s taken longer than expected for economies to adjust. The New York Fed’s Global Supply Chain Pressure Index has eased considerably in recent months:

Powell has also expressed deep concern that continued high inflation could shift inflation expectations higher, and that should that occur, the economic pain of addressing inflation would then be much greater. Stiglitz and Baker question the likelihood of such an upward expectations shift, given that inflation expectations have fallen in recent months. Perhaps, though, Powell’s tough talk on inflation helps to keep inflation in check, and turning dovish now would be premature.

Furthermore, it may be that the difference between the Fed’s viewpoint and that of Stiglitz and Baker is not that vast. Fed projections in June had rates peaking in 2023 at just shy of 4%. If the Fed raises rates 75bp in September, as expected, to 3.00%-3.25%, rates will already be very close to meeting those projections; either rate hikes will then need to slow or projections will need to change. Powell’s positioning likely gives him greater flexibility to continue to lead the Fed in a more hawkish direction, and Powell may be seeking such flexibility. If such action is warranted by poor inflation data, then Powell has already given a heads up to markets of his intentions; if future data is more benign, then the Fed may opt to take its foot off the break, and markets and the economy would have a more pleasant surprise.

###

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. This material has been prepared for informational purposes only, and is not intended to be or interpreted as a recommendation. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice.

‹ Back