By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

Markets and the Debt Ceiling

Image Source: http://www.fridaynewsletter.com

Last month the US hit the debt limit set by Congress, and the federal government began “extraordinary measures” that should buy Congress a few more months to raise the debt ceiling, should it so be inclined. Hardline Republicans are seeking spending cuts in exchange for raising the debt limit, while the White House has said it will not negotiate on this matter. Treasury Secretary Janet Yellen has warned that if the US does default on its debt, a recession is likely, and a global financial crisis would be possible as well.

As conflicts over the debt ceiling have become routine, the accounting gimmicks that comprise the “extraordinary measures” used to keep the government afloat can hardly be considered extraordinary anymore, as they’ve been used to alleviate debt crises in 2002, 2003, 2011, 2013, 2014, 2015, 2017-18, 2019, and 2021. Still, while the risk of debt default remains low, the risk has risen, and we would expect markets to take such elevated risk into account. AllianceBernstein’s AJ Rivers and Lucas Krupa sketch out market implications of the debt ceiling standoff.

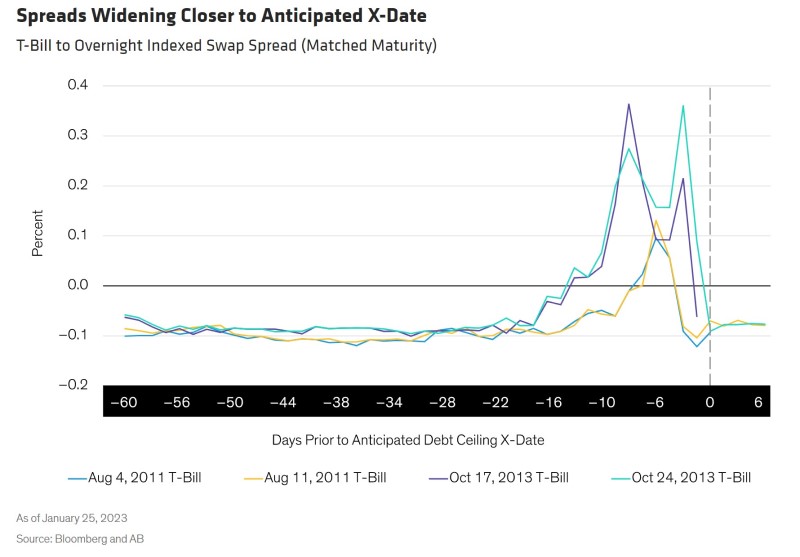

At some point in time, labeled the X-date by Rivers and Krupa, the federal government will run out of extraordinary measures it can take. The authors note that as that point nears, US Treasury spreads widen slightly:

Default, should it occur, wouldn’t mean that the US will fail to pay its interest and principal, but it would mean that such payments would be delayed until the debt ceiling is raised. The spread, which is about 30-50bp, is due to these payment delays.

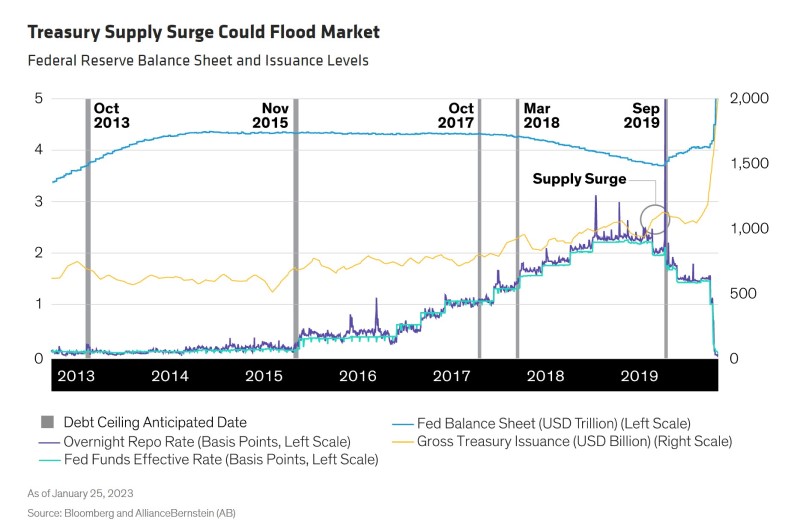

Rivers and Krupa also argue that volatility could increase, as the US Treasury keeps its Treasury General Account in a tight range, issuing T-bills aggressively when cash is needed, and paying down aggressively when cash is not. They also note that the Fed’s ongoing plan to reduce its balance sheet is another complicating factor—the unwinding of the balance sheet, combined with Treasury T-bill issuance, could flood markets:

However, the authors add that the Fed has implemented a Standing Repo Facility to provide primary dealers with cash if need be, so they do not expect funding rates to spike as they did in 2019.

All in all, if President Biden and Congress come to an agreement before the X-date, the consequences of debt ceiling shenanigans appear to be closer to a nuisance than a crisis. How funding markets, equities markets, and political and economic actors would respond to a default is the unknown risk, and one that we hopefully will not have to experience later this year.

###

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. This material has been prepared for informational purposes only, and is not intended to be or interpreted as a recommendation. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice.

‹ Back