By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

OPEC’s Murky Future

OPEC has functioned as a frequently successful oil cartel over the past 50 years, but as Noah Smith argues, it is facing increasing pressure from two fronts. OPEC has benefitted from the higher prices resulting from its choice to restrict oil supplies, as shown most acutely by the high oil prices during the 1970s, but built into the nature of cartels is the incentive to cheat. If one country pumps oil beyond its agreed amount, it can then increase its profits by selling that additional oil at close to the globally high price level. But if all OPEC members were to cheat and overproduce, world oil prices would be pushed down and the cartel would become less profitable.

In the runup to and the early stages of the Ukraine war, oil prices rose due to supply concerns and then fell as recession concerns and China’s continued COVID restrictions reduced demand. The first difficulty for OPEC, as Smith points out, is that economic sanctions on Russia have made it more difficult for OPEC to increase prices by cutting supply again.

European sanctions have resulted in less imported oil from Russia, so Russia has turned to selling heavily to India and China, who have been happy to oblige…for a price. Smith notes that these countries have taken advantage of Russia’s urgent need for continued war funding by negotiating prices significantly lower than that of West Texas crude—at about $57 per barrel instead of $72 per barrel. Following the G7 meeting last year much of the world also agreed to a price cap on Russian oil of $60 per barrel.

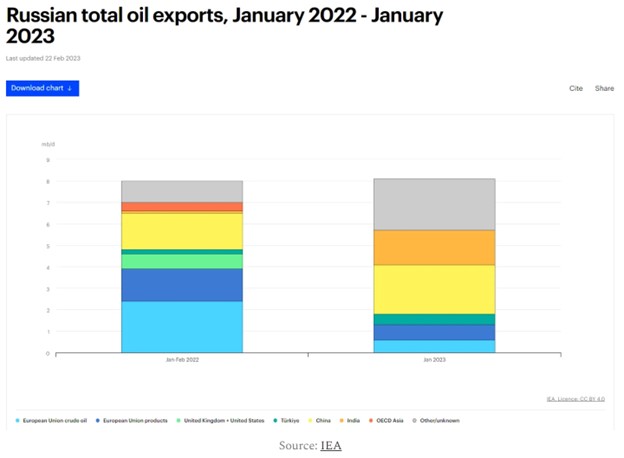

In effect, Smith remarks, Russian oil purchasers formed a buyers cartel designed to allow Russian oil sales while squeezing out much of their profits. Russia has maintained its oil exports despite their lessened profitability, with a major shift from selling to the European Union to selling to China and India:

It may be difficult for OPEC to cut production as a whole when Russia is reluctant to do so. Moreover, OPEC faces a second source of pressure from the continuing emergence of electric vehicles over the coming decade. The IEA projects oil consumption to fall about 5% by the end of the decade, so oil producers have incentive to sell as much oil as they can now before demand falls. Smith speculates that after 50 years of relative dominance, OPEC may find itself subject to a reversal of fortune, by which we enter a new era of cheap oil.

###

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. This material has been prepared for informational purposes only, and is not intended to be or interpreted as a recommendation. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice.

‹ Back