By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

Quarterly Market Commentary

Second Quarter 2022 Key Takeaways

When we looked back at the first quarter of 2022, we saw a quarter in which markets struggled, but the downturn could have been much worse. In the second quarter of 2022, we got to see what much worse

looked like. High inflation brought about a rising rate environment which may bring about a recession; high valuations meant that stocks had the potential to fall a long way. While some recent economic fallout, such

as from China’s zero‐COVID policy and Russia’s invasion of Ukraine, may recede over time, significant damage to economies and markets has been done in the interim.

Virtually no area of the market escaped unscathed during Q2 2022. The S&P 500 posted a second quarter loss of 16.1%, while developed markets fell 14.5%, emerging markets dropped 11.5%, and the Russell 2000 plunged 17.2%. When combined with first quarter losses, as of June 30th the S&P 500 lost 20.0% for the year, developed markets dropped 19.6%, emerging markets fell 17.6%, and the Russell 2000 declined 23.4%. The

second quarter largely continued and expanded the grim news from Q1.

Unfortunately, in a rising rate environment, fixed income would offer no save haven. With inflation burning hotter and longer than expected, rates rose sharply as markets anticipated that the Fed would be forced to respond with increasingly aggressive rate hikes. The US agg was down 4.7% for just Q2 2022, and ended June down 10.4% for this year. The global agg fared even worse, with a decline in Q2 of 8.3% and a total drop for the year of 13.9% as of June’s end. Treasury rates continued their climb in Q2: the 2‐year rate began the year at 0.73%, ballooned to 2.28% by March, and to 2.92% as of June 30th. Longer‐term rates showed a similar pattern—a significant rise in Q1, followed by further swelling in Q2, with the 10‐year rate going from 1.52% to 2.32% to 2.98% from December to June, and the 30‐year rate from 1.90% to 2.44% to 3.14% over that span. Credit markets survived with less damage in Q1, but struggled in Q2, with high yield down 9.3% in Q2 (and 12.8% through June), and floating rate dropping 5.2% for Q2 (and 5.7% through June).

On the macroeconomic side, the GDP outlook is mixed, but employment recovery has remained surprisingly firm. The latest estimate of Q1 2022 GDP is a 1.6% decline; projections for Q2 GDP growth are generally in the 2% range, which is down from previous estimates. The overall picture is still an overheated economy that the Fed is seeking to cool over the coming months, and with unemployment still low at 3.6%, the Fed may

feel it has enough room to raise rates while attempting to engineer a soft landing for the economy.

There’s no silver linings to a bear market, but it is noteworthy that equity valuations and interest rates have normalized significantly, so in terms of upside, there may be a better opportunity set of investments as the downturn runs its course. Moreover, while the bear market has wiped out 2021’s S&P gains, it has come nowhere near eradicating the market’s post‐COVID recovery has a whole. Going forward, the biggest wild card is the Fed’s ability to cool inflation, and at what cost to GDP and employment. Of course, the Ukraine invasion, continued COVID variants, climate concerns, and relations with China all could pose additional headwinds that could prolong or deepen the downturn. Overall, we expect a shift over time to a more traditional portfolio—higher rates means bonds hold greater future

appeal, and equity valuations have become more intriguing. In anticipation, we sold off our liquid alternative sleeve, which helped buffer portfolios during this bear market, and expect to re‐enter bond and equity markets as opportunities arise.

Second Quarter 2022 Investment Letter

Simply put, the second quarter of 2022 started with markets teetering under the strain of geopolitical shocks, high oil prices, a rising rate environment, and continued COVID‐induced supply chain fallout, all of which were layered upon valuations that were already high to begin with. The last straw may have been the continued onslaught of inflation, as Fed projections continued to underestimate its strength and grip. And so markets fell, and fell further. There is certainty the potential for additional losses, as past downturns have sometimes exceeded the current one, but the popping of the valuation bubble has eased such concerns to an extent. It’s worth remembering that at the end of 2020, the S&P 500 closed at 3,756. At the end of June, 2022, the S&P 500 closed at 3,785. While a near 0% return over the past 1.5 years isn’t anything to brag about, it is a common occurrence as markets fluctuate, even if stomachchurning during quarters like these.

Second Quarter 2022 Market Update

The decline in US equities was broad‐based in Q2 2022 with small, mid, and large cap indices all posting double digit losses. As often happens during a downturn, growth got hit much harder than value—large growth lost 28% YTD through June 30th, whereas large value declined only 13%; small growth was down 30%, but small value dipped just 17%. All US sectors fell in Q2 as well, with consumer staples the “best” performer at ‐5%, and consumer discretionary the worst at ‐26%. YTD, energy is still up 30% thanks to rising prices, while all other sectors are underwater. As mentioned before, this quarter saw the S&P 500 fall 16.1%, the Russell 2000 17.2%, developed markets 14.5%, and emerging markets 11.5%. Bond markets continued their downward spiral, as the Fed accelerated its rate hikes in response to everhigher inflation. The US agg fell 4.7% and the global agg 8.3%, while the 10‐year rate rose 66bp to 2.98% and the 30‐year rate climbed 70bp to 3.14%. Credit markets suffered similar damage, with both high yield and floating rate losing over 5% for the quarter. Yields are coming off their near‐zero lows, but still have room to grow; the Fed is expected to continue to raise rates steadily in the coming months, which may make bonds more appealing. The VIX remained elevated, as it was in Q1 2022, but overall, the rapid decline in equities hasn’t been accompanied by an egregious amount of volatility.

Update on the Macro Outlook

Inflation is the primary storyline coursing through the US and the global economy. We can debate how much inflation was due to fiscal stimulus, easy money, supply chain snarls, oil price shocks, or shifts in post‐pandemic consumption and employment patterns. The answer is likely “all of the above,” but however we dole out the credit, the essential questions are how inflation can be brought down, and at what cost.

The how, at least, is fairly straightforward in terms of process. The Fed is raising rates to cool the economy—so far it’s been 25bp in March, 50bp in May, 75bp in June, and 75bp more expected in July, with likely more to come after that. However, in its latest “dot plot” in June, the median Fed member believes that rates will peak at around 4% before falling in 2024 and beyond. A 75bp increase in July and September already puts the federal funds rate at 3%, so it appears the Fed is hoping that a short, fairly sharp rate increase will be enough to reverse inflation, and that rate increases can slow by the end of the year.

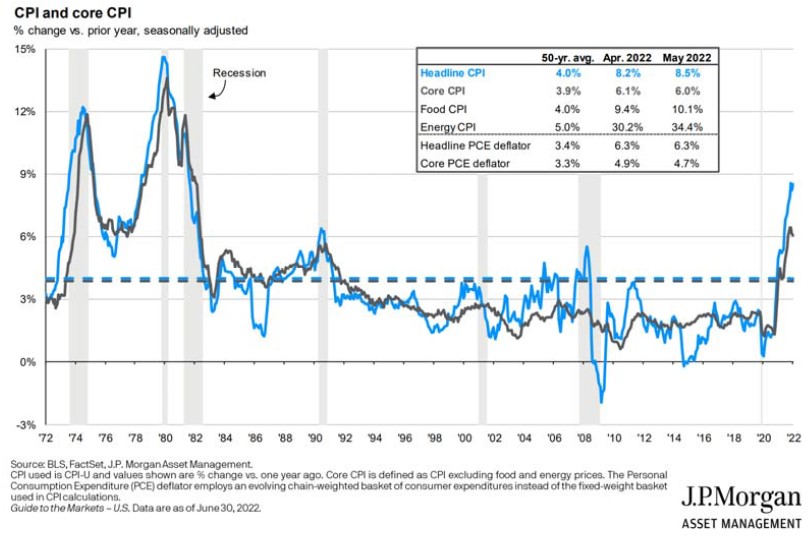

How’s the plan working? Well, if you look at current inflation, it appears the Fed initiative has gained little traction:

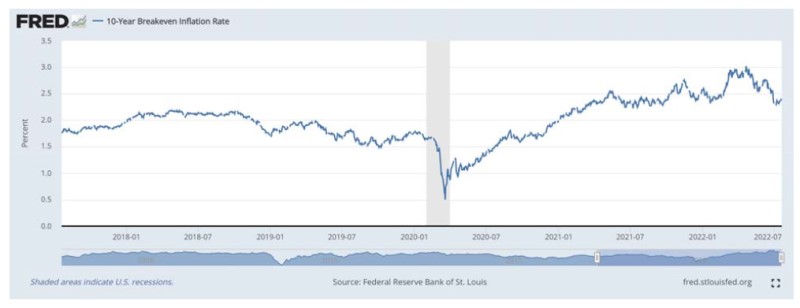

Headline and core inflation for June wasn’t any better, either, at 9.1% and 5.9%, respectively. It does take time for rate hikes to course their way through the economy, so we’d expect any impacts on inflation to accrue over time. However, the Fed has been telegraphing rate hikes for months; it is discouraging from an inflation perspective that prices haven’t begun to taper off. Another perspective on inflation comes from markets, via the breakeven inflation rate. This vantage point is much more encouraging with respect to the longer‐term inflation outlook:

The 10‐year inflation rate, which is a measure of expected inflation derived from 10‐year Treasury spreads, shows market participants expect inflation over the next 10 years to be, on average, about 2.4%. This number is down about 0.5% from its level 3 months ago, and isn’t that far from the Fed’s 2% target. When you factor in that a high baseline level of inflation this year is pushing up the 10‐year average, the breakeven inflation rate from 2024‐2032 would be even closer to 2%.

Bond markets could be wrong, of course, but it’s noteworthy that they are not sounding the inflation alarm. At the very least, bond markets provide a signal that high inflation isn’t likely to be embedded in the economy just yet, whereby firms raise prices and workers demand wage increases in anticipation of expected inflation over the coming years. In other words, bond markets are currently priced as if the Fed will be able to handle the inflation problem, whether through rate hikes or through other factors, such as COVID impacts and energy supply shocks, diminishing over time. Moreover, there is nothing magical about the 2% inflation target; as we noted last quarter, if inflation falls to near target levels, the Fed may decide to allow inflation to settle in the 2‐3% range rather than slow the economy further in an effort to wring out the last bit of excess inflation.

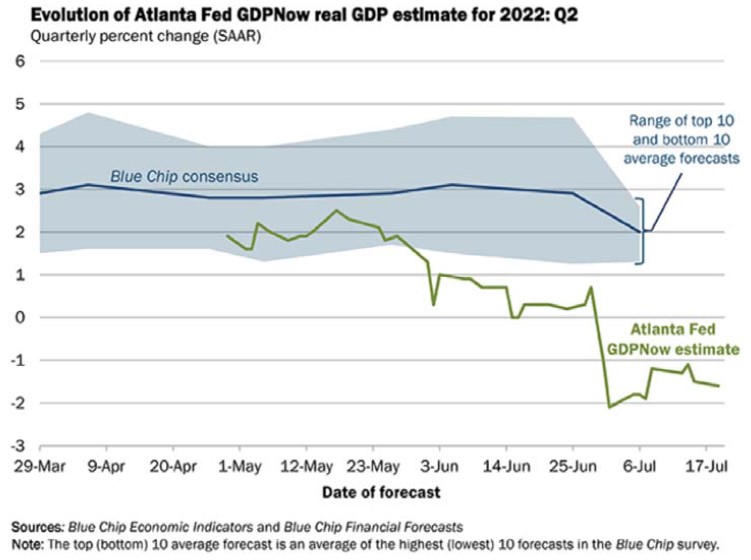

How is the rising rate environment affecting the overall economy? The GDP picture is strange right now; GDP actually fell slightly in Q1 2022, and forecasts for Q2 2022 are mixed:

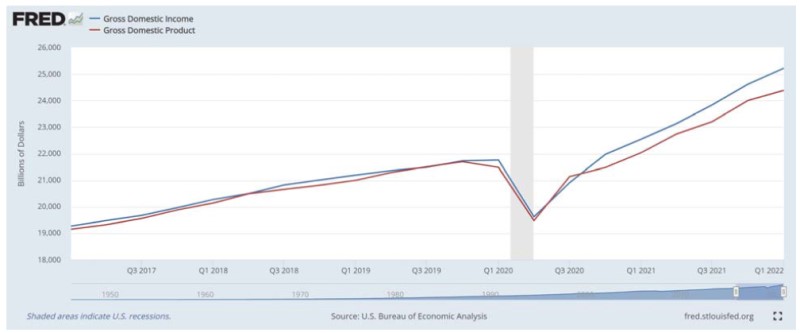

Consensus forecasts project modest GDP growth of around 2% for Q2 but the Atlanta Fed’s current estimate has GDP declining by about 1.5% during that period. There are even discrepancies around GDP growth itself— there’s an alternative measure of the size of the economy, called gross domestic income (GDI), which should theoretically be equal to gross domestic product (GDP); historically these two measures have been closely aligned, but recently they have grown apart:

The gap between GDP and GDI suggests that there is some sort of measurement error that’s occurred in the past 2 years, but in which direction we can’t say. We would argue that COVID has been so disruptive to the global economy that we should take any single data point with a grain of salt, and focus instead on a broader range of economic and market data.

The unemployment rate has remained low even as the Fed has been raising rates; as of June the unemployment rate was just 3.6%. The Fed may have the breathing space to normalize rates to the 3‐4% range without incurring major damage to the jobs market, given our strong employment baseline. The next few months appear relatively straightforward for the Fed; deeper challenges, if they arise, could stem from either persistently high inflation that’s insufficiently responsive to rate hikes, or a sudden downturn that plunges the economy into recession.

The recent decline in oil prices has been welcome news, and should improve headline inflation numbers (though not core inflation). Further repercussions of the Russian invasion of Ukraine are still unclear, as is the impact on any new COVID variants, particularly in China, which is still enforcing its zero‐COVID policy with lockdowns, and whose economy has been struggling.

Portfolio Positioning

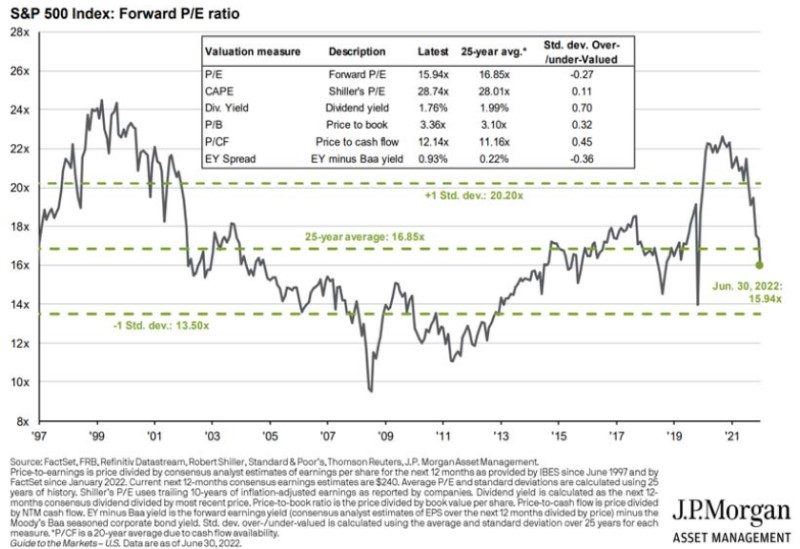

A 20% decline in the S&P 500 was not the way we were hoping that valuations would become more normalized, but when life gives you lemons, we’re trying to note the proverbial lemonade:

There is the larger question of whether the 25‐year average is the “new normal” or if we should look back even further, when P/E ratios were even lower. Either way, valuations have shifted into territory much more in line with their historical norms.

As equities approached bear market territory, we sold off our liquid alternative investments in most portfolios, as they had served their purpose in providing diversification and ballast during a difficult market environment. The basket performed significantly better than stocks and lost only a fraction of what the bond portfolio lost during the decline through May of 2022. In addition to raising cash to meet client income needs, we sought to position ourselves with cash on hand to reinvest in the coming months in areas of the market that are now more attractively priced.

The current investment environment remains challenging. Recession risks remain elevated as the Fed pushes rates higher to bring inflation lower. The most recent inflation print was higher than expected and shows that inflation has been particularly sticky; this may cause higher than usual volatility in both stocks and bonds in the coming months.

Closing Thoughts

Heading into spring 2022, we expected inflation data to remain hot. With that said, the May CPI was higher than expected and did not show the downward trajectory we were hoping for. The markets reacted accordingly and sold off both stocks and bonds heading into the close of the second quarter. As we composed this piece, the June CPI came in even hotter. Inflation was at 9.1% for June—nearly as high as Great Britain’s most recent report. Inflation is clearly stickly and plaguing almost all of the developed world. While we anticipate declining inflation numbers as we head into the fall, it will likely be a choppy ride. The markets will, most likely, go along for the ride and provide high volatility. Stocks are significantly more attractive than they were when the year began, but we would advise caution when adding to risk. Expectations for returns in the intermediate and long‐term may be attractive, but the short‐term will most likely be bumpy. Foreign stocks have had the double whammy of high inflation and a strong dollar, and their returns have shown it thus far in 2022. We expect Europe to have a difficult time in the near‐term, so additional weakness is expected. However, the opportunity in the foreign space may be substantial coming out of a possible recession with the combination of attractive relative valuations and a possibly strong export environment.

Fixed income remains troublesome. The US bond index is down double digits for the year with interest rates rising. The Federal Reserve is likely to keep the federal funds rate moving higher to try to tame inflation. We don’t see longer term rates rising significantly over the coming year, but they almost certainly will have some upward trajectory. We continue to favor higher quality short‐term bond strategies for any upcoming cash needs. Beyind those investments, we are leaning on multi‐sector approaches with the ability to lower duration while targeting attractive segments of the bond market. Beyond multi‐sector strategies, we feel the risk/reward tradeoff has improved for emerging market bonds. The strong dollar has hampered the local currency side of these strategies, and any reversal on currency would be beneficial. While year‐to‐date bond returns have been painful, the higher yields make the strategies more attractive as we move forward.

Moving out of the liquid alternative funds in most portfolios following the strong 2022 relative performance has raised cash levels. We anticipate adding money back to both stocks and bonds in the second half of the year as opportunities present themselves.

—JMS Team

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. Certain material in this work is proprietary to and copyrighted by Litman Gregory Analytics and is used by JMS Capital Group Wealth Services LLC with permission. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. Any references to future returns are not promises ‐ or even estimates ‐ of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation for a specific investment. Past performance is not a guarantee of future results.

With the exception of historical matters, the items discussed are forward‐looking statements that involve risks and uncertainties that could cause actual results to differ materially from projected results. We have based these projections on our current expectations and assumptions about current and future events ‐ as of the time of this writing. While we consider these expectations and assumptions to be reasonable, they are inherently subject to significant business, economic, competitive, regulatory and other risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond our control. There can be no assurances that any returns presented will be achieved.

‹ Back