By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

Quarterly Market Commentary

Third Quarter 2022 Key Takeaways

Markets again endured an ugly quarter, as equities slid once more into bear territory and bonds continued their historically poor performance. The promise of a rebound in July and August was obliterated in September, as any hopes for a quick and easy inflation reversal vanished, along with any prospects of an imminent Fed pullback from its rapid rate hike regime. While we expect markets to rebound in the longer run, as they have so many times before following a bear market, the more immediate future is murky. Between globally high inflation, the Russian invasion of Ukraine and a subsequent potential energy crisis in Europe, and tightening monetary policy across much of the globe, there are multiple economic fires that need to be contained. As the market rebound showed earlier in the summer, if hopes revive that inflation can be tamed with a soft economic landing, then a market turnaround could be sharp and swift. So far, though, inflation has showed unexpected staying power, and the Fed has been taking increasingly aggressive action, hoping to curb inflation with interest rate hikes before it puts down deeper roots into the economic landscape.

The rising rate regime has once again hammered markets nearly across the board. The S&P fell 4.9% in Q3 2022, developed international dropped 9.3%, and emerging markets plunged 11.5%. For the year, all three of these market areas are in bear market territory, with losses year‐to‐date of 23.9% for the S&P 500, 26.8% for developed international, and 27.0% for emerging markets. Small caps and real estate also declined in Q3, and both are down over 25% for the year.

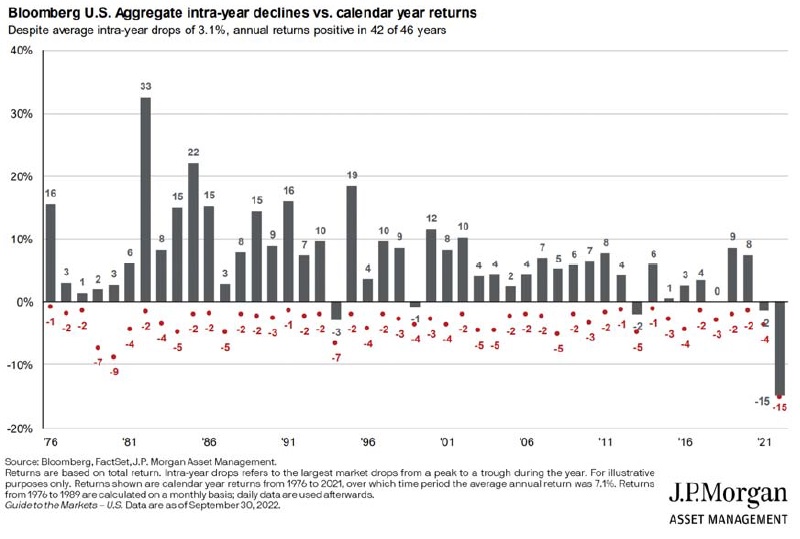

Bonds provided no relief for the stock market’s woes. As poor inflation news poured in, central banks tightened monetary policy more aggressively, and the worsening rising rate environment continued to mire bonds in a deep downturn. The US agg fell another 4.8% in Q3 and ended the quarter down 14.6% YTD. Developed international bonds fared even worse, posting losses of 8.9% for Q3 and an astonishing 24.9% through Q3. High yield fared somewhat better, with only marginal losses for the quarter, but nearly a 15% loss YTD. Not surprisingly, these losses dovetail with the sharply rising rates across US Treasuries, as the 2‐year rate started the year at 0.73% but ended Q3 at 4.22%. Longterm rates also continued their pronounced climb‐‐the 10‐year rate began the year at 1.52%, and through the next 3 quarters rose to 2.32%, 2.98%, and 3.83%; the 30‐year rate showed a similar pattern, starting at 1.90%, then ballooning to 2.44%, 3.14%, and 3.79% over the next 9 months.

On the macroeconomic side, the GDP outlook is tepid, but the labor market has remained surprisingly tight in the face of significant Fed rate hikes. GDP in Q1 and Q2 fell by 1.6% and 0.6%, respectively, but GDP in Q3 is expected to rise by about 1‐2%. Unemployment declined over the third quarter from 3.6% to 3.5%, which may give the Fed greater impetus for more aggressive rate hikes to cool the economy, soften labor markets, and bring down inflation. Markets have been anticipating a recession, which as of this writing appears increasingly likely; the critical question is whether a recession would be mild or severe. The answer to this question would likely have significant influence on any market turnaround.

Bear markets bring considerable pain, but they do not last forever. Market rebounds, once they occur, have typically been strong. Valuations and interest rates have moved much closer to their historical norms, so there is reason for longer‐term optimism. In the interim, there are still many economic challenges as well as political ones—inflation has justifiably been the most prominent macroeconomic story, but Russia’s invasion of Ukraine, China’s zero‐COVID policy, and increased tensions with China over trade and Taiwan can all have large downstream impacts on the global economy. We do not know whether equity or bond markets have hit bottom, but we do believe that if upcoming inflation reports are positive, then markets could rise swiftly in anticipation of a slowdown in central bank tightening. We have been looking to reenter attractive areas of the market to take advantage of a potential surge, but on a limited basis, given the risks associated with higher than normal market volatility.

Third Quarter 2022 Investment Letter

The story of the third quarter of 2022 is largely a story of inflation. Despite a series of sharp rate hikes by the Fed, core inflation has not fallen. The Fed is likely to raise rates higher, and keep them elevated longer, than previously anticipated. The Fed is exerting more effort into cooling the economy, and market prices have responded accordingly. Inflation is a global problem as well as a US one, so we are witnessing rate hike regimes in much of the developed world. The timing and extent of equity and bond market recovery is significantly contingent on whether inflation begins to ease in the coming months.

Third Quarter 2022 Market Update

July and August were actually good months for equities, but the September swoon hit hard, as it became increasingly clear that inflation’s grip was not going to loosen easily. The third quarter hit value harder than growth, but that’s hardly a consolation given growth’s massive decline during the first half of the year. By September 30th, most areas of the US market reached bear market territory, with large value the “best” performer at ‐17.8%. The big picture for US equities is that value ended Q3 down about 20%, and growth ended down about 30%, with large‐, mid,‐ and small‐cap companies declining roughly in equal measure. There simply isn’t any good news here. Sectoral performance in Q3 was generally negative, with communication services and real estate posting double digit losses, but energy and consumer discretionary posting small gains. For the year, though, all sectors except for energy are down, typically by over 20%. Most market areas ended Q3 in bear market territory, including the S&P 500, developed international, emerging markets, small caps, and real estate, with year to date losses in the 20%‐30% range.

Bond markets have had a historically poor year, and continued their downward spiral, as the Fed and other central banks continued their rate hikes in response to ever‐higher inflation. It’s not an exaggeration to say that this has been by far the worst bond market in decades:

The US agg fell almost 5% and the global agg nearly 9% in Q3, and are down an astonishing 15% and 25%, respectively, through September’s end. The 10‐year rate rose another 85bp to 3.83% and the 30‐year rate climbed 65bp to 3.79%. Credit markets fared somewhat better in Q3, but high yield is still down about 15% this year. The one silver lining going forward is that yields are up sharply, so bonds now provide greater promise as a source of steady income. The VIX remained elevated, and we would expect market choppiness to continue, but we believe this higher than normal volatility to be a symptom of macroeconomic and market events rather than a cause.

Update on the Macro Outlook

The more things change, the more they stay the same:

“Inflation is the primary storyline coursing through the US and the global economy. We can debate how much inflation was due to fiscal stimulus, easy money, supply chain snarls, oil price shocks, or shifts in post‐pandemic consumption and employment patterns. The answer is likely “all of the above,” but however we dole out the credit, the essential questions are how inflation can be brought down, and at what cost.”

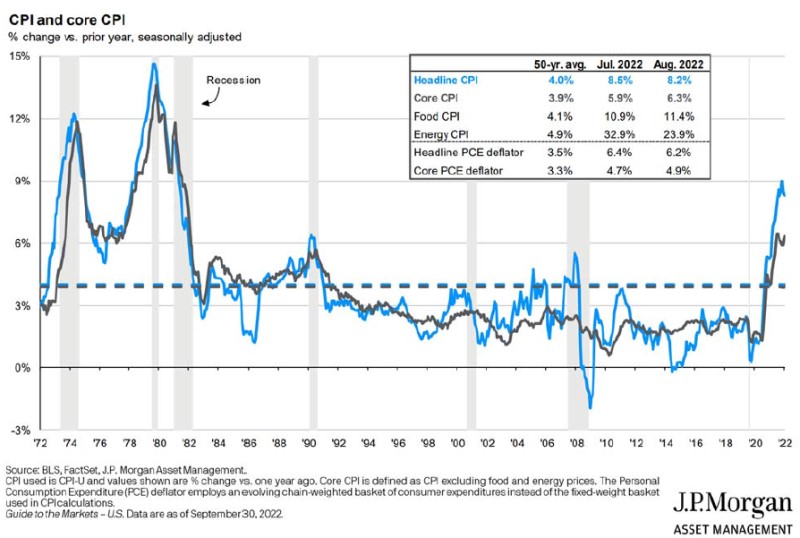

The above quote is from our Q2 2022 newsletter, and what’s unfortunate is that so little has changed on the inflationary front in the past 3 months. It’s true that monetary policy tends to have a lagged impact, as it takes time for rate hikes to course their way through the economy, but we’ve had 300bp in rate hikes this year, including 225bp through July, and yet inflation has remaimed unfazed:

While headline inflation has come down a little bit, thanks to lower oil prices, core inflation, which excludes volatile energy and food prices, actually rose over the quarter. Considering how closely the Fed monitors core inflation, its 6.3% rate suggests that more rate hikes are in the offing, and that higher rates may need to remain in place for a longer period of time. Fed Chair Jerome Powell has warned that some pain is likely in store for households and businesses, and that a sustained period of below trend growth is probably required to reduce inflation. In other words, the Fed intends to continue its aggressive rate hikes to cool the economy, thereby hopefully cooling inflation, and is willing to accept a certain cost to labor markets, households, and businesses in order to do so.

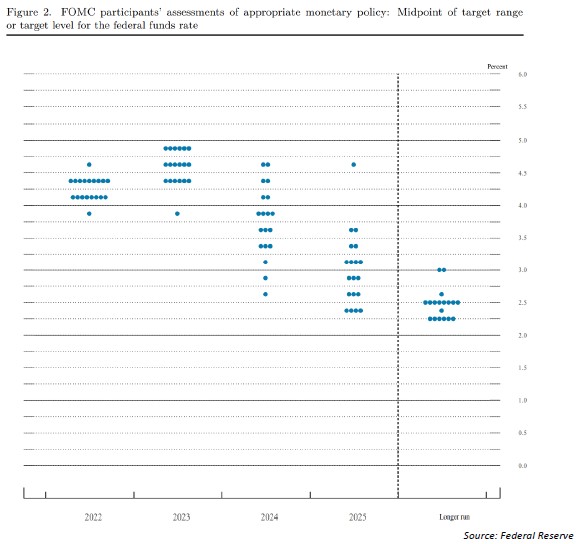

If Fed projections are to be believed, though, rates may peak over the coming year:

The federal funds rate is currently at 3.00%‐3.25%. Fed projections have this rate rising to over 4% by year end, but peaking at less than 5% in 2023. These rates are much higher than recent norms, hence the dramatic rise in treasury yields and mortgage rates—but we’re nowhere near the double digit interest rates used to combat inflation during the 1980s. This dot plot could also be wishful thinking—the Fed has had to revise its interest rate estimates upward over the past year. But the Fed is at least projecting rate hikes to wind down over the coming year, and then for rate cuts to occur in 2024 and 2025.

Markets also appear to be presuming that inflation will be taken care of, as the 10‐year breakeven inflation rate, a measure of expected inflation derived from 10‐year Treasury spreads, remains below 3% and stable:

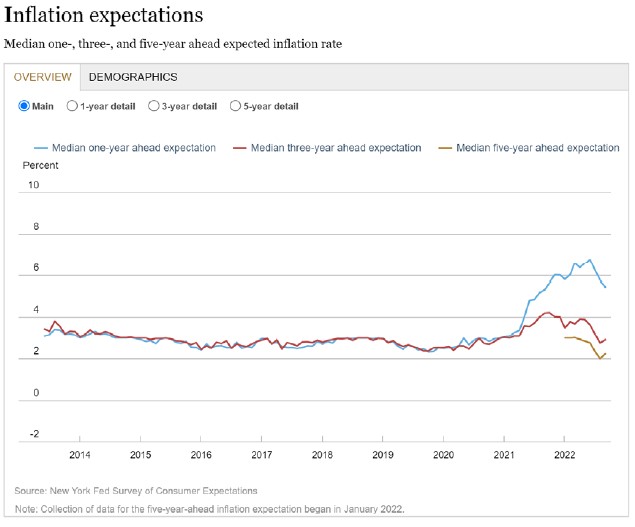

The New York Fed’s Survey of Consumer Expectations indicates that consumers are also not expecting high inflation to persist much beyond the next year:

So inflation is very high right now, but both market participants and consumers expect inflation to normalize over the next few years. Fed hawkishness may be contributing to this confidence, so we don’t expect a dovish turn anytime soon. And economists don’t know much about how inflation expectations evolve (understandably, since the post‐COVID economy has taken us into uncharted territory), so it’s impossible to know how stable these inflation beliefs are. But if core disinflation finally starts to take hold in earnest, the Fed appears to have room to pause rate hikes to observe whether the inflation rate is following a glide path to near 2%.

The unemployment rate continues to defy gravity, as it shrunk to 3.5% in Q3 despite the ever‐increasing weight of higher interest rates on the economy. At this point some economic models are predicting a recession as a near certainty, while others are still uncertain. The larger question isn’t whether a recession will occur but how severe a recession would likely be. Current Fed projections have unemployment peaking at less than 5%; if the Fed can normalize inflation while keeping the federal funds rate and the unemployment rate below 5%, then it seems likely that any ensuing recession would be on the mild side. The risk is that inflation continues to be relatively unresponsive to rate hikes, so that the Fed would then face the terrible dilemma of high inflation versus a sharp recession.

Though inflation has been the primary driver of our economic woes, other challenges lie ahead, including the continued repercussions of the Russian invasion of Ukraine, such as low energy supplies and high energy prices in Europe, as well as challenges in China, which carries the burden of imposing its zero‐COVID policy, and whose economy appears unlikely to meet growth expectations.

Portfolio Positioning

The bad news is that equity performance has been awful this year. The good news is that this section is about portfolio positioning, and the equity opportunity set has become increasingly attractive:

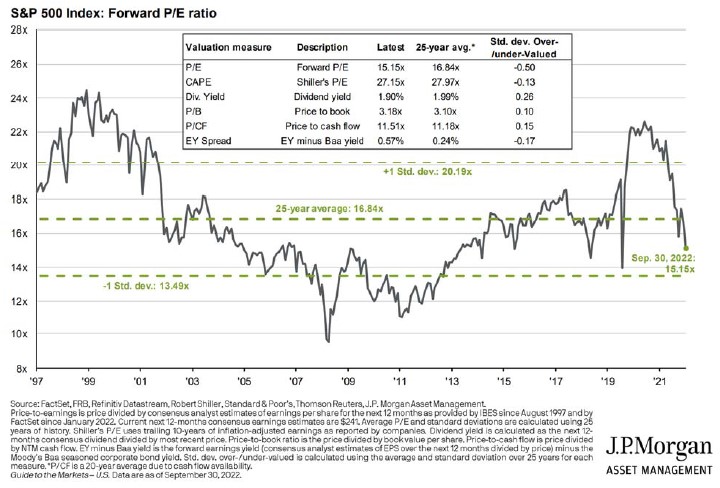

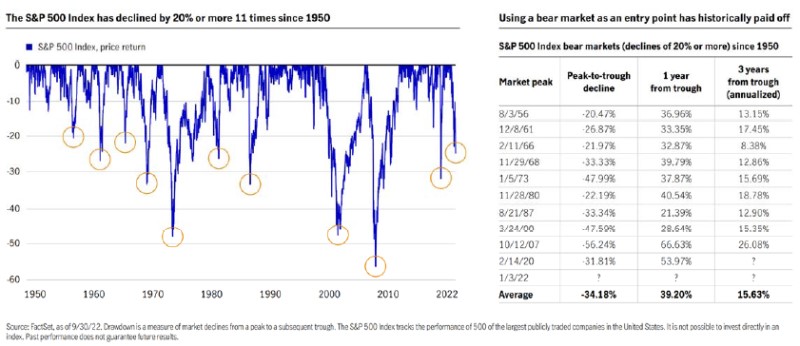

As of quarter end, the S&P 500 was about 10% below its 25 year average valuation level. Large cap stocks are significantly cheaper than they were at the start of 2022. However, we should note that if we look back over a longer time period than 25 years, average valuations are then lower, so this area of the market, while still attractive, is not something that we would label a screaming buy. Still, large cap US stocks have historically done very well after bottoming out during a bear market decline of more than 20%. As shown below, in the previous 10 declines of this magnitude, stocks bounced over 20% in each period after 1 year from the market trough.

In the short term, we favor value over growth, as many value sectors will be either less sensitive to interest rate increases or will benefit from those increases. We do acknowledge that if the Fed pivots and becomes more dovish, we could see a snapback rally in technology stocks and other growth segments of the market. We continue to see good value in lower capitalization US stocks. When compared to large cap counterparts, small US companies, with the exception of the COVID‐19 decline in 2020, have not been this cheap versus large cap stocks since the tech bubble at the turn of the century. We believe diversification into these areas will be beneficial in the coming years. Foreign stocks also continue to look historically attractive following a decade of underperformance versus their US counterparts. However, the US dollar strength in 2022 and possible continued strength in the coming months could hamper relative returns for both developed international stocks and emerging market stocks in the short term. We feel allocations to these segments are still warranted; however, we currently have limited that allocation to approximately 20 percent of equities for most portfolio strategies.

On the fixed income side, where the misery has been almost as great as that of stocks for 2022, our view is that the majority of the pain is in the rear view. While we anticipate rates continuing to move higher in the coming months, it is likely that most of the rate increases will be complete by early 2023. Nearly all bond asset classes have been hit hard in 2022, with double digit losses in nearly all segments outside short term bonds and floating rate bank notes. The good news is that yields are much higher today than at the start of the year, and the forward looking return scenarios are more rosy. After more than a decade of punishment, savers can now earn reasonable yields on low risk fixed income with even short term treasury bills yielding around 4%. There will likely be opportunities over the next year for price appreciation for multisector bonds that have the ability to exploit mispriced assets, and the yield on some emerging market bond strategies are now in excess of 10%, providing a good base for returns even with anticipated volatility in the future. We do have some concerns about high yield debt, as spreads have not widened greatly, and still present some short and medium‐term risks if the economy experiences a hard landing and defaults spike. Overall, the total return for diversified bond portfolios should be attractive in the next 12‐24 months.

Closing Thoughts

As difficult as 2022 has been, we are hopeful that the worst is behind us. Inflation has been stickier than many anticipated, including the Federal Reserve…and consequently, the Fed deemed it necessary to raise rates more aggressively, resulting in a continued downward spiral in both stock and bond markets. Many other central banks have also been struggling to contain inflation, and we have seen the same dismal returns for foreign equities and bonds. At this point, we are waiting to see whether all of the Fed’s efforts start to gain traction in the inflation fight, and hoping that the Fed’s projections are correct that the majority of rate hikes are behind us.

We can’t predict precisely when inflation and other data will turn the corner, so we are continuing to hold some cash heading into the end of the year, to maintain flexibility to add to both stock and bond investments as attractive opportunities arise. With higher rates and cheaper valuations, the outlook for the future has become more promising, and we hope that over the coming year that post bear market history repeats itself, and gives portfolios a chance to recover much of their 2022 losses.

—JMS Team

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. Certain material in this work is proprietary to and copyrighted by Litman Gregory Analytics and is used by JMS Capital Group Wealth Services LLC with permission. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. Any references to future returns are not promises ‐ or even estimates ‐ of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation for a specific investment. Past performance is not a guarantee of future results.

With the exception of historical matters, the items discussed are forward‐looking statements that involve risks and uncertainties that could cause actual results to differ materially from projected results. We have based these projections on our current expectations and assumptions about current and future events ‐ as of the time of this writing. While we consider these expectations and assumptions to be reasonable, they are inherently subject to significant business, economic, competitive, regulatory and other risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond our control. There can be no assurances that any returns presented will be achieved.

‹ Back