Weekly Market Commentary

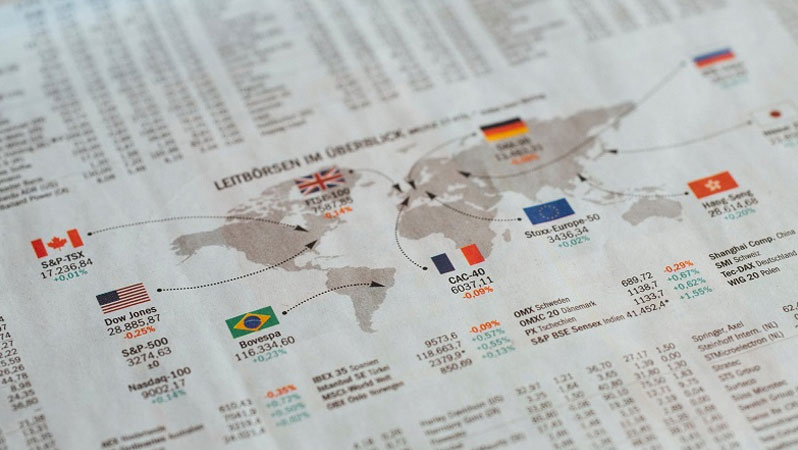

There was a gapers’ block in financial markets last week as equity investors slowed to see what the United States Treasury bond market was up to.

Read More

There was a gapers’ block in financial markets last week as equity investors slowed to see what the United States Treasury bond market was up to.

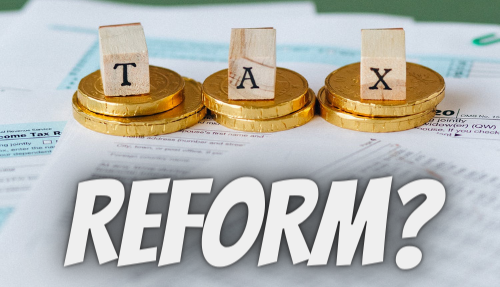

Read MoreLast week 130 countries agreed to a corporate tax framework with a minimum tax rate of 15%.

Read More

What begins with the letter “I”? Infrastructure is essential and sometimes taken for granted. Pipes carry drinking water to our homes, offices, and healthcare facilities...

Read More

On Thursday, the White House reached a preliminary agreement with a bipartisan group of senators on infrastructure investments.

Read More

Is that a hawk? The Federal Reserve Open Market Committee (FOMC) met last week.

Read More

Lumber price surged this spring to record levels, spurring concerns about the Fed’s relative nonchalance towards inflation.

Read More

It’s transitory. It’s not transitory. It’s transitory. It’s not transitory. Media analysts were plucking the inflation daisy petals last week.

Read More

Biogen’s treatment for Alzheimer’s disease was unexpectedly approved last week by the FDA. The ruling was a surprise given that the FDA’s advisory had voted ...

Read More

Pulling the economy out of the shed. If you’ve ever stored tools or machinery in a shed or garage for an extended period of time, you know ...

Read More

The good news for electric vehicle manufacturers is that battery costs have been plummeting over time, and that the cost of electric vehicles may soon achieve parity with ...

Read More

Although it’s pulled back from its peak, Tesla’s stock has still risen more than tenfold in the past two years.

Read More

Are we at a tipping point? One side effect of the pandemic was a collapse in demand for oil, which led to “the largest revision to the value ...

Read More

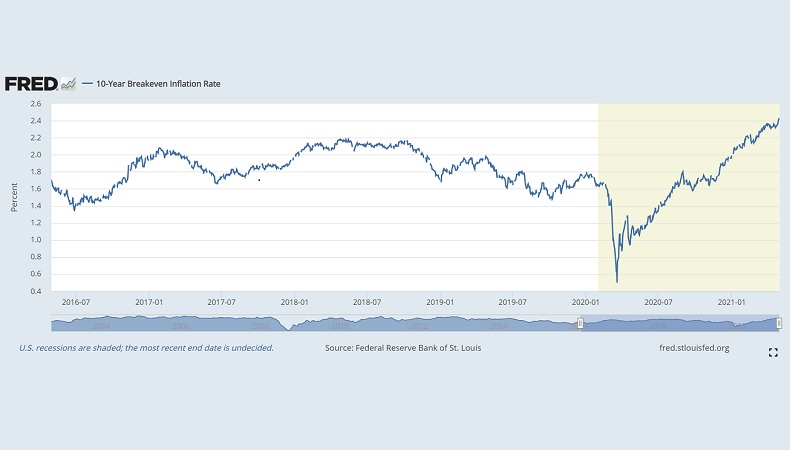

The combination of dovish monetary policy and stimulative fiscal policy has given rise to inflation fears.

Read More

Here’s the current 10-year breakeven inflation rate, which reflects market expectations of the average inflation rate over the next 10 years.

Read More

Uncle Inflation is here. Will he overstay his welcome? Ever since the financial crisis, central banks have pursued expansionary monetary policies to encourage reflation and avoid deflation.

Read More

The jobs report released last Friday contained unexpectedly bad news. Normally a gain of 266,000 jobs would be a strong month...

Read More

Like a gender reveal gone wrong, last week’s employment report delivered an unexpected surprise.

Read More

It’s Spring and economic recovery is in the air. Last week, the Bureau of Economic Analysis reported the U.S.

Read More

Here’s the current 10-year breakeven inflation rate, which reflects market expectations of the average inflation rate over the next 10 years.

Read More

The Markets It wasn’t just the price of pork chops. Last week, as investors weighed the news, strong corporate earnings were offset by higher grocery ...

Read More Comments

First Quarter 2021 Key Takeaways. The market marches on. On the heels of its post-recession resurgence last year, stocks have continued their remarkable runup.

Read More

Where are Treasury bonds going? The direction of bond yields is influenced by investors’ expectations for economic growth, among other factors.

Read More

Investors didn’t stumble over inflation last week. Why not? Inflation – rising prices of goods and services – can be measured in a variety of ways.

Read More

The Biden Administration is seeking to enact a $2 trillion infrastructure plan, which then raises the question of how to finance this government spending.

Read More

The market’s recovery over the past year can be attributed in part to expectations that COVID would be largely suppressed and that the economy could then regain ...

Read More

Zoom, zoom, zoom. Big economies tend to recover from recessions about as quickly as semi-trucks accelerate from stop lights.

Read More

In recent years the Fed’s communication style has become increasingly direct...

Read More

Last week, unemployment claims were looking good and consumers were feeling good...

Read More

Last week we discussed optimistic economic growth forecasts for 2021, highlighted by a Goldman Sachs projection of 8% growth...

Read More

What are professional asset managers thinking? Bank of America recently published the results of its March global asset managers’ survey...

Read More

3,2,1 Takeoff! We may still be cooped up far more than we want to be, but if Goldman Sachs is right, the economy is ready to take off. As ...

Read More Comments

This weekend the Senate passed a $1.9 trillion COVID relief package. The House is expected to approve the bill later this week and send it on to President Biden ...

Read More Comments

Students of financial markets may have noted a historically unusual event last week.

Read More

After the yield curve flattened in 2020, with the US 10 year rate falling to under 0.6% and the 30 year rate briefly slipping to under 1%, we’ve started to see significant ...

Read More

It’s a contrarian’s dream come true. Contrarian investors like to buck the trend.

Read More

The Fed has long been known as a chief fighter of inflation, ever since Paul Volcker in the 1980s hiked interest rates sharply in an effort to bring ...

Read More

Way back, when radio disk jockeys played 45-rpm vinyl singles, the A-side of a disk was the song the record company was promoting and the other side.

Read More

The stunning recovery of US and global markets has been generally excellent for portfolios, but leaves a challenge going forward...

Read More

It’s not a black diamond ski run yet, but the yield curve for U.S. Treasuries is steeper than it has been in a while.

Read More

The Gamestop short squeeze has prompted discussion of short selling, in which an investor who believes a stock is overvalued borrows shares of that stock...

Read More

They say people watching the same event often see different things.

Read More

If a group of Redditors dislike hedge funds, dislike the idea of shorting a gaming company that has sentimental value for many...

Read More

Fourth Quarter 2020 Key Takeaways. Once again, as abnormal as 2020 has been, as we still sit months away from widespread COVID vaccine implementation...

Read More

The Biden Administration has proposed an additional $1.9 trillion in spending on a COVID relief package, and unsurprisingly, many Republicans ...

Read More

Last week, as COVID-19 vaccination efforts continued, there was speculation about stock market corrections and asset bubbles.

Read More

Investors were rocked by economic data showing the economy hit the brakes hard in December.

Read More

Bitcoin has been in the news quite a bit lately, both for its meteoric rise and its sharp selloffs.

Read More

The November 3rd election appeared to be a mixed bag for the Democratic Party.

Read More

Last week was the cherry on top of a turbulent year for investors.

Read More

U.S. stock markets remained calm as a fresh chapter opened in the coronavirus stimulus saga last week.

Read More

We were going to close out what’s been a very interesting 2020 by discussing 2021 capital market forecasts.

Read More

Congress is at $900 billion, will they hear $1.4 trillion, $1.4 trillion, governments at $900 billion, who’ll go $1.4 trillion, $1.4 trillion…

Read More

We don’t expect to see much in the way of bipartisan legislation in the coming years, but perhaps Democrats and Republicans were imbued with the holiday spirit

Read More

What’s Next for the Fed? The Federal Reserve meets on December 15th and 16th. With COVID-19 cases spiking and the economic recovery faltering, the ...

Read More Comments

The Markets When it comes to beverages, frothy can be delicious. In what may be the least inspiring description of fizzy drinks ever written, a group ...

Read More Comments

Joe Biden is expected to nominate Janet Yellen for Treasury Secretary for his administration...

Read More

Major stock indices in the United States hit all-time highs on Friday, despite a lackluster employment report and a surge in COVID-19 cases...

Read More

For many of us, Thanksgiving in 2020 was a more subdued affair, as rising caseloads of COVID-19...

Read More

Last week, vaccine optimism immunized investors against signs of economic weakness.

Read More

The last time the United States elected a new president during a crisis, in 2008, the recovery was a painful and protracted one.

Read More

The U.S. economy is like a semi-trailer truck. No one likes being stuck behind a semi at a stoplight because big trucks don’t go from zero ...

Read More

News broke a little over a week ago that preliminary results for Pfizer’s COVID-19 vaccine showed that the vaccine reduced symptomatic cases by 90%...

Read More

Vaccine can be a powerful word. It’s worth 14 points in Scrabble (42 on a triple word square) and, last week, it was worth a whole lot more ...

Read More

As with all elections, about half the country will be pleased (and half the country displeased) with the final outcome.

Read More

It’s said markets hate uncertainty, but that wasn’t the case last week. Despite tremendous uncertainty about the outcome of the United States election, major ...

Read More

By the end of the third quarter of 2020, the S&P 500 had completed a remarkable recovery and, after more than a 30% loss in March, closed up 5% YTD.

Read More

Last week, financial markets and economic data told very different stories. Reviewing economic data is a bit like looking in a rear view mirror.

Read More

Third Quarter 2020 Key Takeaways. As much as we are still mired in the COVID‐19 crisis, not to mention 2020 election mudslinging, markets have largely continued to shrug off the ...

Read More

John M. Schneider, President of Pittsburgh-based JMS Capital Group, resigns from Board of Directors for California-based AEHR Test Systems.

Read More

It was a turbulent week for investors. Waves of positive and negative news buffeted financial markets last week.

Read More

Yes. No. Maybe? Markets were sharply focused on the status of stimulus last week. First, it was on. Then, it was off. Then, it might be on. Then, ...

Read More

Despite all the turmoil in the world, led by COVID‐19, the US Presidential Election horserace has had a very consistent result for months: Joe Biden is clearly leading, ...

Read MoreLast week, the third quarter of 2020 came to an end – and the fourth quarter delivered a doozy of an October surprise.

Read MoreFor four weeks, the U.S. stock market has sparked and sputtered like a campfire in light rain.

Read More

Weekly Market Commentary September 14, 2020 The Markets Last week, the Nasdaq Composite Index set another record. So far, 2020 has been memorable for many reasons, not the least of which ...

Read More

Weekly Market Commentary September 8, 2020 The Markets Stock markets in the United States retreated a bit last week. U.S. stocks have been trending higher for months. Last week, ...

Read More CommentsWeekly Market Commentary August 31, 2020 The Markets The stock market is rallying like it’s 1986. August has been a good month for stock investors. At the end ...

Read More

February 2, 2026

January 19, 2026

January 1, 2026

December 31, 2025

December 1, 2025

Advisory services offered through JMS Capital Group Wealth Services, LLC, a Registered Investment Advisor.

Business Continuity Plan • Privacy Policy • JMS Capital Group Wealth Services, LLC ADV Brochure • CRS Form

417 Thorn Street #300

Sewickley, PA 15143

By using our website, you agree to the use of cookies as described in our Cookie Policy